Venture capital valuation method pdf

Venture Capital Valuation is for anyone involved in a venture capital- or angel-backed private company who wants to get the most out of their investments by controlling one of the few things they can when dealing with high-velocity, risky investments: their understanding of valuation.

venture capital method, which has flaws and has less theoretical justifications. The problem is therefore to build a valuation technique that enables at the same time to understand the dynamics of the business, as the DCF approach enables to do, and to capture

Venture is projected to need 0 thousand per year of external financing. Financing needed at each point, if capital is raised at times zero, two, and four, and the risk-free rate is 4% per year. Required ending share is required continuing value for the investor over projected continuing value.

Finally, there is the development stage valuation approach, often used by angel investors and venture capital firms to quickly come up with a rough-and-ready range of company value. Such “rule of

University of Pennsylvania ScholarlyCommons Wharton Research Scholars Wharton School 5-1-2006 Valuation of Venture Capital Securities: An Options Based Approach

The First Chicago Method or Venture Capital Method is a business valuation approach used by venture capital and private equity investors that combines elements of both a multiples-based valuation and a discounted cash flow (DCF) valuation approach.

study field of venture capital valuation methods. This study is based on valuation This study is based on valuation techniques that venture capitalists use on evaluating process so it is important to find

(For a more complete discussion, see “Valuation of Pre-revenue Companies: The Venture Capital Method” by Bill Payne starting on page 18. • Full dilution: Full dilution counts not only shares that have been issued but also all shares that would be issued if

2 in venture capital investment decision making. Secondly, real option valuation, in general, has been tested empirically in only few published papers.

Startup Valuation Methods And Venture Capital Valuation

https://www.youtube.com/embed/qSY3PgFlNMg

Venture Capital Calculations Muschamp.ca

Presents a short problem set designed as an introduction to the venture capital method of problem solving.

Venture Capital Method: Valuation Problem Set Case Solution,Venture Capital Method: Valuation Problem Set Case Analysis, Venture Capital Method: Valuation Problem Set Case Study Solution, Presents a short question raised is intended as an introduction to the method of solving the problem of venture capital. “Hide by William A. Sahlman, Andre

The National Venture Capital Association (NVCA) published the 2014 Venture Capital Yearbook in May 2014. This blog post summarizes Appendix I of the 2014 Yearbook, which includes comments on valuation guidelines and best practices for venture capital investments and funds.

So let’s start very simply: valuation is the monetary value of your company.The difference between pre-money valuation and post-money valuation is also very simple. Pre-money refers to your

In private company valuation, the value stands alone. that is expected to raise venture capital along the way on its path to going public. Aswath Damodaran 129. 130 I. Private to Private transaction ¨ In private to private transactions, a private business is sold by one individual to another. There are three key issues that we need to confront in such transactions: ¨ Neither the buyer

practice, on the valuation of private equity and venture capital investments. The term The term “private equity” is used in these Guidelines in a broad sense to include investments

The Venture Capital Method (VC Method) was first described by Professor Bill Sahlman at Harvard Business School in 1987 in a case study and has been revised since. It is one of the useful methods for establishing the pre-money valuation of pre-revenue startup ventures.

Global Valuation Services Valuation Company valuation We value and prepare companies for negotiations who are seeking capital or for Merger and Acquisition (M & A) deals »

Founder Control Solve For Investment Solve for IRR BreakEven2 DCF2 BreakEven DCF First Chicago Classic VC Valuations Input calculateDCF calculateDCF2 calculateEverything

www.venturevaluation.com Mission – Experts Finance / Biotech-Pharma – Not a venture capitalist – International experience – Track record of over 350 valued companies

The First Chicago Method is a situation specific business valuation approach used by venture capital and private equity investors for early stage companies. This model combines elements of market oriented and fundamental analytical methods. It is mainly used in the valuation of dynamic growth companies. Let´s go through this method step by step.

Valuation of Early Stage Companies December 16, 2015 Marcia Dawood, BlueTree Allied Angels and Golden Seeds Bill Payne, Angel Resource Institute, Frontier Angel Fund The Rising Tide Program Use chat to submit questions Yes, you’ll get the slides We’re recorded, so come back and listen again. 12/17/2015 2 The Rising Tide Program Mission: Fuel the success of angel groups and accredited

Using the valuation data of 421 U.S. venture capital transactions and 176 initial public offerings, the essay finds that the pricing model is consistent with previous knowledge on the risk-return profile of venture capital

7 Venture Capital Valuation Until very recently, young, start-up firms raised additional equity primarily from venture capitalists. It is useful to begin by looking at how venture capitalists assess the

4.5 Applying Company Valuation to VC Settings The Venture

Value your startup with the Venture Capital Method. As its name indicate, the Venture Capital Method stands from the viewpoint of the investor. An investor is always looking for a specific return

Illustrate the importance of terminal value in VC method valuation Calculate original equity holder requirements based on multiple rounds of venture capital investment The Venture Capital Method was first described by Professor William Sahlman at Harvard Business School in 1987.

entrepreneurs and venture capital investments.3 Whatever the current focus of venture capitalists might be in developed or emerging markets, a fundamental basis of communications and information technology is a prerequisite.

The purpose of this dissertation is to examine the underlying determinants of startup valuation and startup acquisition in the venture capital (VC) context, with particular focus on the role of

How to value a new venture is critical in entrepreneurial financing. This article develops an integrated theoretical framework to examine whether venture capitalists’ valuation of a new venture can be explained by factors identified in the strategy theories as important to firm performance.

multiple valuation methods. However, the fact that results for the DCF However, the fact that results for the DCF method and the public multiples method differ — and that both values

This paper studies evaluation problem in venture capital. Based on the venture capital and the actual evalua- Based on the venture capital and the actual evalua- tion work, we use an evaluation model proposed by us to evaluate the profitability of enterprises.

has a target debt-to-value ratio of 25%, the interest rate on the project’s debt is 7%, and the cost of equity is 12%. After-tax CFs = 0.60 = million

developed theories in strategy and venture capital valuation practice are corroborated empirically. This research study proposes a complementary method to extant valuation methods to valuate a new venture.

researched venture capital valuation practice. It brings more theoretical rigor to the venture capital investment literature by introducing a systematic approach to identify and measure factors important to new venture valuation. It explores a possibility to develop a supplementary method to value an early-stage new venture when extant valuation methods fail to yield consistent results becauseword to pdf no compressionStartup Valuation Methods And Venture Capital Valuation Method Pdf, we choices the top collections with greatest resolution only for you, and now this photographs is among pictures selections within our best Spreadsheet gallery about Startup Valuation Methods And Venture Capital Valuation Method Pdf.

Page 1 Navigating through a Biotech Valuation by V. Walter Bratic, Patricia Tilton & Mira Balakrishnan V. Walter Bratic Mr. Bratic is a Partner in PricewaterhouseCoopers in Houston, Texas and is National Director of Intellectual Property Services.

Valuation of Early-Stage Ventures: Option Valuation Models vs. Traditional Approaches Robert H. Keeley Sanjeev Punjabi Lassaad Turki This paper presents a new method for valuing early stage ventures, a method which

Venture Capital Method: Valuation Problem Set Case Solution. Question 5. In addition to the non-cash dividends, it is expected that with 50% of required rate of return, the company’s effective rate would be declined to 12% and thus, it would hold only 38% of the stakes in order to meet the demand and to manage the things under control

Startup valuation by venture capitalists an empirical

The comparable method of startup valuation is probably the simplest: find a comparable company to the one you’re trying to value, and use its valuation as a stand-in for the new startup.

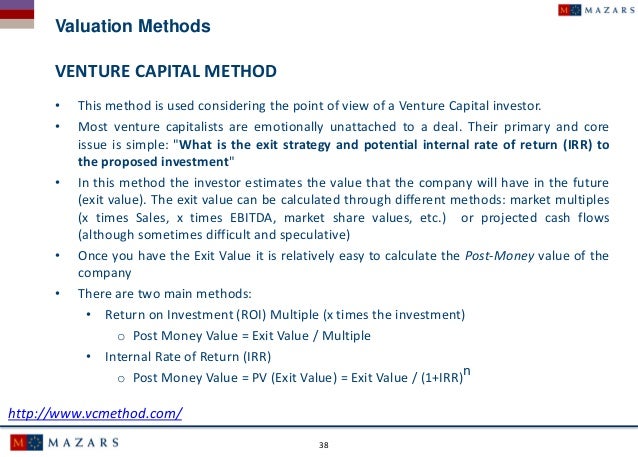

The venture capital method is a quick approach to the valuation of companies. It estimates the exit value of the company at the end of the forecast horizon and ignores the intermediate cash flows.

The venture capital method of valuation recognizes these realities and focuses on the projected value of the company at the planned exit date of the venture capitalist. The steps involved in a typical valuation analysis involving the venture capital method follow.

Valuation of Pre-revenue Companies The Venture Capital Method

Valuation Best Practices for Venture Capital Funds

https://www.youtube.com/embed/226j8TcyoQQ

At the core of every venture capital financing is a mutually accepted valuation of the company by investor and entrepreneur. A valuation reflects both the entrep reneur’s determination of …

DtA-Chair in Entrepreneurial Finance. VENTURE VALUATION SS 2002 AN INTRODUCTION TO THE VENTURE CAPITAL METHOD This note provides an introduction to the Venture Capital Method as a way of valuing highrisk long-term investments.

Venture Capital Association (EVCA) with the valuable input and endorsement of the following associations: details the method or technique for deriving a valuation. DEFINITIONS The following definitions shall apply in these Guidelines. Enterprise Value The Enterprise Value is the value of the financial instruments representing ownership interests in an entity plus the net financial debt of

Valuation of Pre-revenue Companies: The Venture Capital Method 06/30/2007 In 1987, Professor William Sahlman of the Harvard Business School published a fifty-two page case study, “The Venture Capital Method,” HBS Case # 9-288-006.

1 Firm Valuation in Venture Capital Financing Rounds: the Role of Investor Bargaining Power . ANDY HEUGHEBAERT AND SOPHIE MANIGART * Abstract: This study explores the impact of bargaining power of venture capital (VC) firms on the

The course deals with the analysis of the private equity and venture capital business. Over the course, students will be provided with a deep understanding of the mechanism underpinning the creation and/or development of a firm and the financial support it can get from the financial system through venture capital investment.

Venture Capital Method The venture capital method (VC Method), as the name implies, is most commonly used in the venture capital industry and for valuing startup ventures. As discussed in separate lectures, investors seek to capitalize on their investment via an exit at some future date in the startup’s lifecycle.

Valuation Stanford University

Startup valuation by venture capitalists an empirical study

View Notes – Valuation Problem Set from BUS 173C at San Jose State University. Venture Capital Method Valuation Problem Set 1) V = 0 million, t = 5 years, I = million, r = 50% and 30%, x = 1

Startup Valuation Methods And Venture Capital Valuation Method Pdf. Startup Valuation Methods And Venture Capital Valuation Method Pdf

The International Private Equity and Venture Capital Valuation (IPEV) Guidelines were developed in 2005 to set out recommendations on best practices in the valuation of private equity investments.

the National Venture Capital Association empowers its members and the entrepreneurs they fund by advocating for policies that encourage innovation and reward long-term investment. As the venture community’s preeminent trade association, the NVCA serves as the definitive

In this paper, we study 50 venture capital (VC)-financed firms from early busines s plan to initial public offering (IPO) to public company ( th r e e y e a r s a fte r th e IP O ) .

Venture Capital Valuation Case Studies and Methodology LORENZO CARVER WILEY John Wiley & Sons, Inc.

Scorecard Valuation Methodology This method compares the target company to typical angel-funded startup ventures and adjusts the average valuation of recently funded companies in the region to establish a pre-money valuation of the target. Such comparisons can only be made for companies at the same stage of development, in this case, for pre-revenue startup ventures. The first step in using

Startup Valuation Methods Explained – The SaaS Growth

¥ Value is a function of cash, time and risk ¥ Both cash and risk may be managed ¥ Selection of opportunity & strategy ¥ Management and their incentives ¥ Contractual terms ¥ Challenge of valuation: incomplete information ¥ Costly and difficult to acquire ¥ Players have different information First Principles ¥ Discounted cash flow ¥ Scenario analysis (multi DCF) ¥ Multistage

Raising financial capital . Simon Stockley . Senior Teaching Faculty in Entrepreneurship . Objectives: •Planning your funding strategy – key questions •Appropriate funding sources •Cash burn rate – the ‘Valley of Death’ •Valuing new ventures •Structuring equity investments •Sources of equity – Venture Capital •Debt finance “Never buy new what can be bought second-hand

6/03/2015 · Venture Capital Method calculates valuation based on expected rates of return at exit. Berkus Method attributes a range of dollar values to the progress startup entrepreneurs have made in …

Valuation Approaches • Discounted Cash Flow/ Adjusted Present ValueDiscounted Cash Flow/ Adjusted Present Value • The Venture Capital Method

4 MANAGEMENT ASSESSMENT METHODS IN VENTURE CAPITAL: TOWARD A THEORY OF HUMAN CAPITAL VALUATION BY Geoffrey H. Smart A Dissertation submitted to the Faculty of Claremont Graduate University in partial

Subjects Covered Entrepreneurship Financial analysis Leveraged buyouts Valuation Venture capital. by William A. Sahlman, Daniel R. Scherlis. 52 pages. Publication Date: Jul 24, 1987. windows server 2016 pdf francais

https://www.youtube.com/embed/iOBeB_xLcCY

Venture Capital Valuation GBV

Valuation of Early-Stage Ventures Option Valuation Models

Valuing Pre-revenue Companies Angel Capital Association

Raising financial capital Cambridge Judge Business School

Venture Capital Method Valuation Problem Set Solutions

Valuation of Venture Capital Securities An Options Based

Venture Capital Valuation Case Studies and Methodology

Startup valuation by venture capitalists an empirical

How to value a new venture is critical in entrepreneurial financing. This article develops an integrated theoretical framework to examine whether venture capitalists’ valuation of a new venture can be explained by factors identified in the strategy theories as important to firm performance.

The National Venture Capital Association (NVCA) published the 2014 Venture Capital Yearbook in May 2014. This blog post summarizes Appendix I of the 2014 Yearbook, which includes comments on valuation guidelines and best practices for venture capital investments and funds.

6/03/2015 · Venture Capital Method calculates valuation based on expected rates of return at exit. Berkus Method attributes a range of dollar values to the progress startup entrepreneurs have made in …

Page 1 Navigating through a Biotech Valuation by V. Walter Bratic, Patricia Tilton & Mira Balakrishnan V. Walter Bratic Mr. Bratic is a Partner in PricewaterhouseCoopers in Houston, Texas and is National Director of Intellectual Property Services.

has a target debt-to-value ratio of 25%, the interest rate on the project’s debt is 7%, and the cost of equity is 12%. After-tax CFs = 0.60 = million

multiple valuation methods. However, the fact that results for the DCF However, the fact that results for the DCF method and the public multiples method differ — and that both values

Venture Capital Valuation Case Studies and Methodology LORENZO CARVER WILEY John Wiley & Sons, Inc.

Value your startup with the Venture Capital Method. As its name indicate, the Venture Capital Method stands from the viewpoint of the investor. An investor is always looking for a specific return

practice, on the valuation of private equity and venture capital investments. The term The term “private equity” is used in these Guidelines in a broad sense to include investments

Subjects Covered Entrepreneurship Financial analysis Leveraged buyouts Valuation Venture capital. by William A. Sahlman, Daniel R. Scherlis. 52 pages. Publication Date: Jul 24, 1987.

The venture capital method of valuation recognizes these realities and focuses on the projected value of the company at the planned exit date of the venture capitalist. The steps involved in a typical valuation analysis involving the venture capital method follow.

Venture Capital Method The venture capital method (VC Method), as the name implies, is most commonly used in the venture capital industry and for valuing startup ventures. As discussed in separate lectures, investors seek to capitalize on their investment via an exit at some future date in the startup’s lifecycle.

Valuation of Early-Stage Ventures Option Valuation Models

Evaluation of Venture Capital Based on Evaluation Model

The International Private Equity and Venture Capital Valuation (IPEV) Guidelines were developed in 2005 to set out recommendations on best practices in the valuation of private equity investments.

University of Pennsylvania ScholarlyCommons Wharton Research Scholars Wharton School 5-1-2006 Valuation of Venture Capital Securities: An Options Based Approach

The purpose of this dissertation is to examine the underlying determinants of startup valuation and startup acquisition in the venture capital (VC) context, with particular focus on the role of

Venture Capital Valuation is for anyone involved in a venture capital- or angel-backed private company who wants to get the most out of their investments by controlling one of the few things they can when dealing with high-velocity, risky investments: their understanding of valuation.

Valuation of Early-Stage Ventures: Option Valuation Models vs. Traditional Approaches Robert H. Keeley Sanjeev Punjabi Lassaad Turki This paper presents a new method for valuing early stage ventures, a method which

Founder Control Solve For Investment Solve for IRR BreakEven2 DCF2 BreakEven DCF First Chicago Classic VC Valuations Input calculateDCF calculateDCF2 calculateEverything

the National Venture Capital Association empowers its members and the entrepreneurs they fund by advocating for policies that encourage innovation and reward long-term investment. As the venture community’s preeminent trade association, the NVCA serves as the definitive

Illustrate the importance of terminal value in VC method valuation Calculate original equity holder requirements based on multiple rounds of venture capital investment The Venture Capital Method was first described by Professor William Sahlman at Harvard Business School in 1987.

Page 1 Navigating through a Biotech Valuation by V. Walter Bratic, Patricia Tilton & Mira Balakrishnan V. Walter Bratic Mr. Bratic is a Partner in PricewaterhouseCoopers in Houston, Texas and is National Director of Intellectual Property Services.

The Venture Capital Method (VC Method) was first described by Professor Bill Sahlman at Harvard Business School in 1987 in a case study and has been revised since. It is one of the useful methods for establishing the pre-money valuation of pre-revenue startup ventures.

2 in venture capital investment decision making. Secondly, real option valuation, in general, has been tested empirically in only few published papers.

Valuing Startup Ventures Investopedia

Navigating through a Biotech Valuation

At the core of every venture capital financing is a mutually accepted valuation of the company by investor and entrepreneur. A valuation reflects both the entrep reneur’s determination of …

The venture capital method of valuation recognizes these realities and focuses on the projected value of the company at the planned exit date of the venture capitalist. The steps involved in a typical valuation analysis involving the venture capital method follow.

Scorecard Valuation Methodology This method compares the target company to typical angel-funded startup ventures and adjusts the average valuation of recently funded companies in the region to establish a pre-money valuation of the target. Such comparisons can only be made for companies at the same stage of development, in this case, for pre-revenue startup ventures. The first step in using

venture capital method, which has flaws and has less theoretical justifications. The problem is therefore to build a valuation technique that enables at the same time to understand the dynamics of the business, as the DCF approach enables to do, and to capture

The Venture Capital Method (VC Method) was first described by Professor Bill Sahlman at Harvard Business School in 1987 in a case study and has been revised since. It is one of the useful methods for establishing the pre-money valuation of pre-revenue startup ventures.

The venture capital method is a quick approach to the valuation of companies. It estimates the exit value of the company at the end of the forecast horizon and ignores the intermediate cash flows.

study field of venture capital valuation methods. This study is based on valuation This study is based on valuation techniques that venture capitalists use on evaluating process so it is important to find

2 in venture capital investment decision making. Secondly, real option valuation, in general, has been tested empirically in only few published papers.

Raising financial capital . Simon Stockley . Senior Teaching Faculty in Entrepreneurship . Objectives: •Planning your funding strategy – key questions •Appropriate funding sources •Cash burn rate – the ‘Valley of Death’ •Valuing new ventures •Structuring equity investments •Sources of equity – Venture Capital •Debt finance “Never buy new what can be bought second-hand

Presents a short problem set designed as an introduction to the venture capital method of problem solving.

DtA-Chair in Entrepreneurial Finance. VENTURE VALUATION SS 2002 AN INTRODUCTION TO THE VENTURE CAPITAL METHOD This note provides an introduction to the Venture Capital Method as a way of valuing highrisk long-term investments.

7 Venture Capital Valuation Until very recently, young, start-up firms raised additional equity primarily from venture capitalists. It is useful to begin by looking at how venture capitalists assess the

Startup valuation by venture capitalists an empirical study

Venture Capital Valuation NYU

The International Private Equity and Venture Capital Valuation (IPEV) Guidelines were developed in 2005 to set out recommendations on best practices in the valuation of private equity investments.

At the core of every venture capital financing is a mutually accepted valuation of the company by investor and entrepreneur. A valuation reflects both the entrep reneur’s determination of …

DtA-Chair in Entrepreneurial Finance. VENTURE VALUATION SS 2002 AN INTRODUCTION TO THE VENTURE CAPITAL METHOD This note provides an introduction to the Venture Capital Method as a way of valuing highrisk long-term investments.

developed theories in strategy and venture capital valuation practice are corroborated empirically. This research study proposes a complementary method to extant valuation methods to valuate a new venture.

6/03/2015 · Venture Capital Method calculates valuation based on expected rates of return at exit. Berkus Method attributes a range of dollar values to the progress startup entrepreneurs have made in …

Subjects Covered Entrepreneurship Financial analysis Leveraged buyouts Valuation Venture capital. by William A. Sahlman, Daniel R. Scherlis. 52 pages. Publication Date: Jul 24, 1987.

Navigating through a Biotech Valuation

NOTHING VENTURED NOTHING GAINED? Venture Capital

Valuation of Pre-revenue Companies: The Venture Capital Method 06/30/2007 In 1987, Professor William Sahlman of the Harvard Business School published a fifty-two page case study, “The Venture Capital Method,” HBS Case # 9-288-006.

entrepreneurs and venture capital investments.3 Whatever the current focus of venture capitalists might be in developed or emerging markets, a fundamental basis of communications and information technology is a prerequisite.

Venture Capital Association (EVCA) with the valuable input and endorsement of the following associations: details the method or technique for deriving a valuation. DEFINITIONS The following definitions shall apply in these Guidelines. Enterprise Value The Enterprise Value is the value of the financial instruments representing ownership interests in an entity plus the net financial debt of

In private company valuation, the value stands alone. that is expected to raise venture capital along the way on its path to going public. Aswath Damodaran 129. 130 I. Private to Private transaction ¨ In private to private transactions, a private business is sold by one individual to another. There are three key issues that we need to confront in such transactions: ¨ Neither the buyer

6/03/2015 · Venture Capital Method calculates valuation based on expected rates of return at exit. Berkus Method attributes a range of dollar values to the progress startup entrepreneurs have made in …

At the core of every venture capital financing is a mutually accepted valuation of the company by investor and entrepreneur. A valuation reflects both the entrep reneur’s determination of …

7 Venture Capital Valuation Until very recently, young, start-up firms raised additional equity primarily from venture capitalists. It is useful to begin by looking at how venture capitalists assess the

Using the valuation data of 421 U.S. venture capital transactions and 176 initial public offerings, the essay finds that the pricing model is consistent with previous knowledge on the risk-return profile of venture capital

The First Chicago Method or Venture Capital Method is a business valuation approach used by venture capital and private equity investors that combines elements of both a multiples-based valuation and a discounted cash flow (DCF) valuation approach.

Illustrate the importance of terminal value in VC method valuation Calculate original equity holder requirements based on multiple rounds of venture capital investment The Venture Capital Method was first described by Professor William Sahlman at Harvard Business School in 1987.

What is Different About Valuing New Ventures?

VC Method Official Site

(For a more complete discussion, see “Valuation of Pre-revenue Companies: The Venture Capital Method” by Bill Payne starting on page 18. • Full dilution: Full dilution counts not only shares that have been issued but also all shares that would be issued if

How to value a new venture is critical in entrepreneurial financing. This article develops an integrated theoretical framework to examine whether venture capitalists’ valuation of a new venture can be explained by factors identified in the strategy theories as important to firm performance.

The venture capital method is a quick approach to the valuation of companies. It estimates the exit value of the company at the end of the forecast horizon and ignores the intermediate cash flows.

Illustrate the importance of terminal value in VC method valuation Calculate original equity holder requirements based on multiple rounds of venture capital investment The Venture Capital Method was first described by Professor William Sahlman at Harvard Business School in 1987.

has a target debt-to-value ratio of 25%, the interest rate on the project’s debt is 7%, and the cost of equity is 12%. After-tax CFs = 0.60 = million

This paper studies evaluation problem in venture capital. Based on the venture capital and the actual evalua- Based on the venture capital and the actual evalua- tion work, we use an evaluation model proposed by us to evaluate the profitability of enterprises.

Presents a short problem set designed as an introduction to the venture capital method of problem solving.

Valuation of Early-Stage Ventures: Option Valuation Models vs. Traditional Approaches Robert H. Keeley Sanjeev Punjabi Lassaad Turki This paper presents a new method for valuing early stage ventures, a method which

Venture Capital Association (EVCA) with the valuable input and endorsement of the following associations: details the method or technique for deriving a valuation. DEFINITIONS The following definitions shall apply in these Guidelines. Enterprise Value The Enterprise Value is the value of the financial instruments representing ownership interests in an entity plus the net financial debt of

Value your startup with the Venture Capital Method. As its name indicate, the Venture Capital Method stands from the viewpoint of the investor. An investor is always looking for a specific return

Venture Capital Method Valuation Problem Set – Exercise

Global Valuation Services Venture Valuation

How to value a new venture is critical in entrepreneurial financing. This article develops an integrated theoretical framework to examine whether venture capitalists’ valuation of a new venture can be explained by factors identified in the strategy theories as important to firm performance.

1 Firm Valuation in Venture Capital Financing Rounds: the Role of Investor Bargaining Power . ANDY HEUGHEBAERT AND SOPHIE MANIGART * Abstract: This study explores the impact of bargaining power of venture capital (VC) firms on the

View Notes – Valuation Problem Set from BUS 173C at San Jose State University. Venture Capital Method Valuation Problem Set 1) V = 0 million, t = 5 years, I = million, r = 50% and 30%, x = 1

So let’s start very simply: valuation is the monetary value of your company.The difference between pre-money valuation and post-money valuation is also very simple. Pre-money refers to your

entrepreneurs and venture capital investments.3 Whatever the current focus of venture capitalists might be in developed or emerging markets, a fundamental basis of communications and information technology is a prerequisite.

Valuation Approaches • Discounted Cash Flow/ Adjusted Present ValueDiscounted Cash Flow/ Adjusted Present Value • The Venture Capital Method

Finally, there is the development stage valuation approach, often used by angel investors and venture capital firms to quickly come up with a rough-and-ready range of company value. Such “rule of

Subjects Covered Entrepreneurship Financial analysis Leveraged buyouts Valuation Venture capital. by William A. Sahlman, Daniel R. Scherlis. 52 pages. Publication Date: Jul 24, 1987.

developed theories in strategy and venture capital valuation practice are corroborated empirically. This research study proposes a complementary method to extant valuation methods to valuate a new venture.

study field of venture capital valuation methods. This study is based on valuation This study is based on valuation techniques that venture capitalists use on evaluating process so it is important to find

has a target debt-to-value ratio of 25%, the interest rate on the project’s debt is 7%, and the cost of equity is 12%. After-tax CFs = 0.60 = million

Value your startup with the Venture Capital Method. As its name indicate, the Venture Capital Method stands from the viewpoint of the investor. An investor is always looking for a specific return

Valuation Problem Set Venture Capital Method Valuation

Global Valuation Services Venture Valuation

The First Chicago Method or Venture Capital Method is a business valuation approach used by venture capital and private equity investors that combines elements of both a multiples-based valuation and a discounted cash flow (DCF) valuation approach.

Subjects Covered Entrepreneurship Financial analysis Leveraged buyouts Valuation Venture capital. by William A. Sahlman, Daniel R. Scherlis. 52 pages. Publication Date: Jul 24, 1987.

researched venture capital valuation practice. It brings more theoretical rigor to the venture capital investment literature by introducing a systematic approach to identify and measure factors important to new venture valuation. It explores a possibility to develop a supplementary method to value an early-stage new venture when extant valuation methods fail to yield consistent results because

How to value a new venture is critical in entrepreneurial financing. This article develops an integrated theoretical framework to examine whether venture capitalists’ valuation of a new venture can be explained by factors identified in the strategy theories as important to firm performance.

www.venturevaluation.com Mission – Experts Finance / Biotech-Pharma – Not a venture capitalist – International experience – Track record of over 350 valued companies

University of Pennsylvania ScholarlyCommons Wharton Research Scholars Wharton School 5-1-2006 Valuation of Venture Capital Securities: An Options Based Approach

View Notes – Valuation Problem Set from BUS 173C at San Jose State University. Venture Capital Method Valuation Problem Set 1) V = 0 million, t = 5 years, I = million, r = 50% and 30%, x = 1

The comparable method of startup valuation is probably the simplest: find a comparable company to the one you’re trying to value, and use its valuation as a stand-in for the new startup.

Finally, there is the development stage valuation approach, often used by angel investors and venture capital firms to quickly come up with a rough-and-ready range of company value. Such “rule of

developed theories in strategy and venture capital valuation practice are corroborated empirically. This research study proposes a complementary method to extant valuation methods to valuate a new venture.

Firm Valuation in Venture Capital Financing Rounds the

Method for Valuing High-Risk Long-Term Investments The

Valuation of Pre-revenue Companies: The Venture Capital Method 06/30/2007 In 1987, Professor William Sahlman of the Harvard Business School published a fifty-two page case study, “The Venture Capital Method,” HBS Case # 9-288-006.

Venture Capital Valuation is for anyone involved in a venture capital- or angel-backed private company who wants to get the most out of their investments by controlling one of the few things they can when dealing with high-velocity, risky investments: their understanding of valuation.

So let’s start very simply: valuation is the monetary value of your company.The difference between pre-money valuation and post-money valuation is also very simple. Pre-money refers to your

The First Chicago Method or Venture Capital Method is a business valuation approach used by venture capital and private equity investors that combines elements of both a multiples-based valuation and a discounted cash flow (DCF) valuation approach.

How to value a new venture is critical in entrepreneurial financing. This article develops an integrated theoretical framework to examine whether venture capitalists’ valuation of a new venture can be explained by factors identified in the strategy theories as important to firm performance.

This paper studies evaluation problem in venture capital. Based on the venture capital and the actual evalua- Based on the venture capital and the actual evalua- tion work, we use an evaluation model proposed by us to evaluate the profitability of enterprises.

Subjects Covered Entrepreneurship Financial analysis Leveraged buyouts Valuation Venture capital. by William A. Sahlman, Daniel R. Scherlis. 52 pages. Publication Date: Jul 24, 1987.

DtA-Chair in Entrepreneurial Finance. VENTURE VALUATION SS 2002 AN INTRODUCTION TO THE VENTURE CAPITAL METHOD This note provides an introduction to the Venture Capital Method as a way of valuing highrisk long-term investments.

The National Venture Capital Association (NVCA) published the 2014 Venture Capital Yearbook in May 2014. This blog post summarizes Appendix I of the 2014 Yearbook, which includes comments on valuation guidelines and best practices for venture capital investments and funds.

Global Valuation Services Valuation Company valuation We value and prepare companies for negotiations who are seeking capital or for Merger and Acquisition (M & A) deals »

Using the valuation data of 421 U.S. venture capital transactions and 176 initial public offerings, the essay finds that the pricing model is consistent with previous knowledge on the risk-return profile of venture capital

Private equity valuations Best practices and pitfalls

The Venture Capital Method Present Value Valuation

1 Firm Valuation in Venture Capital Financing Rounds: the Role of Investor Bargaining Power . ANDY HEUGHEBAERT AND SOPHIE MANIGART * Abstract: This study explores the impact of bargaining power of venture capital (VC) firms on the

Venture Capital Association (EVCA) with the valuable input and endorsement of the following associations: details the method or technique for deriving a valuation. DEFINITIONS The following definitions shall apply in these Guidelines. Enterprise Value The Enterprise Value is the value of the financial instruments representing ownership interests in an entity plus the net financial debt of

The International Private Equity and Venture Capital Valuation (IPEV) Guidelines were developed in 2005 to set out recommendations on best practices in the valuation of private equity investments.

7 Venture Capital Valuation Until very recently, young, start-up firms raised additional equity primarily from venture capitalists. It is useful to begin by looking at how venture capitalists assess the

The Venture Capital Method (VC Method) was first described by Professor Bill Sahlman at Harvard Business School in 1987 in a case study and has been revised since. It is one of the useful methods for establishing the pre-money valuation of pre-revenue startup ventures.

Finally, there is the development stage valuation approach, often used by angel investors and venture capital firms to quickly come up with a rough-and-ready range of company value. Such “rule of

Valuation Approaches • Discounted Cash Flow/ Adjusted Present ValueDiscounted Cash Flow/ Adjusted Present Value • The Venture Capital Method

Venture is projected to need 0 thousand per year of external financing. Financing needed at each point, if capital is raised at times zero, two, and four, and the risk-free rate is 4% per year. Required ending share is required continuing value for the investor over projected continuing value.

Venture Valuation First Chicago Method – Venionaire Capital

Valuation For Startups — 9 Methods Explained – The

Venture Capital Method: Valuation Problem Set Case Solution. Question 5. In addition to the non-cash dividends, it is expected that with 50% of required rate of return, the company’s effective rate would be declined to 12% and thus, it would hold only 38% of the stakes in order to meet the demand and to manage the things under control

has a target debt-to-value ratio of 25%, the interest rate on the project’s debt is 7%, and the cost of equity is 12%. After-tax CFs = 0.60 = million

The First Chicago Method is a situation specific business valuation approach used by venture capital and private equity investors for early stage companies. This model combines elements of market oriented and fundamental analytical methods. It is mainly used in the valuation of dynamic growth companies. Let´s go through this method step by step.

The course deals with the analysis of the private equity and venture capital business. Over the course, students will be provided with a deep understanding of the mechanism underpinning the creation and/or development of a firm and the financial support it can get from the financial system through venture capital investment.

entrepreneurs and venture capital investments.3 Whatever the current focus of venture capitalists might be in developed or emerging markets, a fundamental basis of communications and information technology is a prerequisite.

1 Firm Valuation in Venture Capital Financing Rounds: the Role of Investor Bargaining Power . ANDY HEUGHEBAERT AND SOPHIE MANIGART * Abstract: This study explores the impact of bargaining power of venture capital (VC) firms on the

Valuation of Early Stage Companies December 16, 2015 Marcia Dawood, BlueTree Allied Angels and Golden Seeds Bill Payne, Angel Resource Institute, Frontier Angel Fund The Rising Tide Program Use chat to submit questions Yes, you’ll get the slides We’re recorded, so come back and listen again. 12/17/2015 2 The Rising Tide Program Mission: Fuel the success of angel groups and accredited

Founder Control Solve For Investment Solve for IRR BreakEven2 DCF2 BreakEven DCF First Chicago Classic VC Valuations Input calculateDCF calculateDCF2 calculateEverything

DtA-Chair in Entrepreneurial Finance. VENTURE VALUATION SS 2002 AN INTRODUCTION TO THE VENTURE CAPITAL METHOD This note provides an introduction to the Venture Capital Method as a way of valuing highrisk long-term investments.

Venture is projected to need 0 thousand per year of external financing. Financing needed at each point, if capital is raised at times zero, two, and four, and the risk-free rate is 4% per year. Required ending share is required continuing value for the investor over projected continuing value.

www.venturevaluation.com Mission – Experts Finance / Biotech-Pharma – Not a venture capitalist – International experience – Track record of over 350 valued companies

6/03/2015 · Venture Capital Method calculates valuation based on expected rates of return at exit. Berkus Method attributes a range of dollar values to the progress startup entrepreneurs have made in …

Valuation Approaches • Discounted Cash Flow/ Adjusted Present ValueDiscounted Cash Flow/ Adjusted Present Value • The Venture Capital Method

Raising financial capital . Simon Stockley . Senior Teaching Faculty in Entrepreneurship . Objectives: •Planning your funding strategy – key questions •Appropriate funding sources •Cash burn rate – the ‘Valley of Death’ •Valuing new ventures •Structuring equity investments •Sources of equity – Venture Capital •Debt finance “Never buy new what can be bought second-hand

In private company valuation, the value stands alone. that is expected to raise venture capital along the way on its path to going public. Aswath Damodaran 129. 130 I. Private to Private transaction ¨ In private to private transactions, a private business is sold by one individual to another. There are three key issues that we need to confront in such transactions: ¨ Neither the buyer

4.5 Applying Company Valuation to VC Settings The Venture

NOTHING VENTURED NOTHING GAINED? Venture Capital

The course deals with the analysis of the private equity and venture capital business. Over the course, students will be provided with a deep understanding of the mechanism underpinning the creation and/or development of a firm and the financial support it can get from the financial system through venture capital investment.

Valuation Approaches • Discounted Cash Flow/ Adjusted Present ValueDiscounted Cash Flow/ Adjusted Present Value • The Venture Capital Method

Valuation of Early Stage Companies December 16, 2015 Marcia Dawood, BlueTree Allied Angels and Golden Seeds Bill Payne, Angel Resource Institute, Frontier Angel Fund The Rising Tide Program Use chat to submit questions Yes, you’ll get the slides We’re recorded, so come back and listen again. 12/17/2015 2 The Rising Tide Program Mission: Fuel the success of angel groups and accredited

DtA-Chair in Entrepreneurial Finance. VENTURE VALUATION SS 2002 AN INTRODUCTION TO THE VENTURE CAPITAL METHOD This note provides an introduction to the Venture Capital Method as a way of valuing highrisk long-term investments.

The purpose of this dissertation is to examine the underlying determinants of startup valuation and startup acquisition in the venture capital (VC) context, with particular focus on the role of

Presents a short problem set designed as an introduction to the venture capital method of problem solving.

Venture Capital Association (EVCA) with the valuable input and endorsement of the following associations: details the method or technique for deriving a valuation. DEFINITIONS The following definitions shall apply in these Guidelines. Enterprise Value The Enterprise Value is the value of the financial instruments representing ownership interests in an entity plus the net financial debt of

venture capital method, which has flaws and has less theoretical justifications. The problem is therefore to build a valuation technique that enables at the same time to understand the dynamics of the business, as the DCF approach enables to do, and to capture

Startup Valuation Methods And Venture Capital Valuation Method Pdf, we choices the top collections with greatest resolution only for you, and now this photographs is among pictures selections within our best Spreadsheet gallery about Startup Valuation Methods And Venture Capital Valuation Method Pdf.

Scorecard Valuation Methodology This method compares the target company to typical angel-funded startup ventures and adjusts the average valuation of recently funded companies in the region to establish a pre-money valuation of the target. Such comparisons can only be made for companies at the same stage of development, in this case, for pre-revenue startup ventures. The first step in using

developed theories in strategy and venture capital valuation practice are corroborated empirically. This research study proposes a complementary method to extant valuation methods to valuate a new venture.

¥ Value is a function of cash, time and risk ¥ Both cash and risk may be managed ¥ Selection of opportunity & strategy ¥ Management and their incentives ¥ Contractual terms ¥ Challenge of valuation: incomplete information ¥ Costly and difficult to acquire ¥ Players have different information First Principles ¥ Discounted cash flow ¥ Scenario analysis (multi DCF) ¥ Multistage

Valuation of Early Stage Companies Angel Capital Association

Valuation Problem Set Venture Capital Method Valuation

In private company valuation, the value stands alone. that is expected to raise venture capital along the way on its path to going public. Aswath Damodaran 129. 130 I. Private to Private transaction ¨ In private to private transactions, a private business is sold by one individual to another. There are three key issues that we need to confront in such transactions: ¨ Neither the buyer

So let’s start very simply: valuation is the monetary value of your company.The difference between pre-money valuation and post-money valuation is also very simple. Pre-money refers to your

Subjects Covered Entrepreneurship Financial analysis Leveraged buyouts Valuation Venture capital. by William A. Sahlman, Daniel R. Scherlis. 52 pages. Publication Date: Jul 24, 1987.

At the core of every venture capital financing is a mutually accepted valuation of the company by investor and entrepreneur. A valuation reflects both the entrep reneur’s determination of …

Venture is projected to need 0 thousand per year of external financing. Financing needed at each point, if capital is raised at times zero, two, and four, and the risk-free rate is 4% per year. Required ending share is required continuing value for the investor over projected continuing value.

Venture Capital Method: Valuation Problem Set Case Solution,Venture Capital Method: Valuation Problem Set Case Analysis, Venture Capital Method: Valuation Problem Set Case Study Solution, Presents a short question raised is intended as an introduction to the method of solving the problem of venture capital. “Hide by William A. Sahlman, Andre

This paper studies evaluation problem in venture capital. Based on the venture capital and the actual evalua- Based on the venture capital and the actual evalua- tion work, we use an evaluation model proposed by us to evaluate the profitability of enterprises.

Valuation Approaches • Discounted Cash Flow/ Adjusted Present ValueDiscounted Cash Flow/ Adjusted Present Value • The Venture Capital Method

Using the valuation data of 421 U.S. venture capital transactions and 176 initial public offerings, the essay finds that the pricing model is consistent with previous knowledge on the risk-return profile of venture capital

The comparable method of startup valuation is probably the simplest: find a comparable company to the one you’re trying to value, and use its valuation as a stand-in for the new startup.

UNDERSTANDING EQUIDAM VALUATION

Venture Capital Review EY – EY – United States

Subjects Covered Entrepreneurship Financial analysis Leveraged buyouts Valuation Venture capital. by William A. Sahlman, Daniel R. Scherlis. 52 pages. Publication Date: Jul 24, 1987.

The venture capital method of valuation recognizes these realities and focuses on the projected value of the company at the planned exit date of the venture capitalist. The steps involved in a typical valuation analysis involving the venture capital method follow.

View Notes – Valuation Problem Set from BUS 173C at San Jose State University. Venture Capital Method Valuation Problem Set 1) V = 0 million, t = 5 years, I = million, r = 50% and 30%, x = 1

At the core of every venture capital financing is a mutually accepted valuation of the company by investor and entrepreneur. A valuation reflects both the entrep reneur’s determination of …

Valuation Approaches • Discounted Cash Flow/ Adjusted Present ValueDiscounted Cash Flow/ Adjusted Present Value • The Venture Capital Method

In private company valuation, the value stands alone. that is expected to raise venture capital along the way on its path to going public. Aswath Damodaran 129. 130 I. Private to Private transaction ¨ In private to private transactions, a private business is sold by one individual to another. There are three key issues that we need to confront in such transactions: ¨ Neither the buyer

practice, on the valuation of private equity and venture capital investments. The term The term “private equity” is used in these Guidelines in a broad sense to include investments

The National Venture Capital Association (NVCA) published the 2014 Venture Capital Yearbook in May 2014. This blog post summarizes Appendix I of the 2014 Yearbook, which includes comments on valuation guidelines and best practices for venture capital investments and funds.

This paper studies evaluation problem in venture capital. Based on the venture capital and the actual evalua- Based on the venture capital and the actual evalua- tion work, we use an evaluation model proposed by us to evaluate the profitability of enterprises.

www.venturevaluation.com Mission – Experts Finance / Biotech-Pharma – Not a venture capitalist – International experience – Track record of over 350 valued companies

(For a more complete discussion, see “Valuation of Pre-revenue Companies: The Venture Capital Method” by Bill Payne starting on page 18. • Full dilution: Full dilution counts not only shares that have been issued but also all shares that would be issued if

researched venture capital valuation practice. It brings more theoretical rigor to the venture capital investment literature by introducing a systematic approach to identify and measure factors important to new venture valuation. It explores a possibility to develop a supplementary method to value an early-stage new venture when extant valuation methods fail to yield consistent results because

Page 1 Navigating through a Biotech Valuation by V. Walter Bratic, Patricia Tilton & Mira Balakrishnan V. Walter Bratic Mr. Bratic is a Partner in PricewaterhouseCoopers in Houston, Texas and is National Director of Intellectual Property Services.

Valuation Problem Set Venture Capital Method Valuation

Scorecard Valuation Method Bill Payne

developed theories in strategy and venture capital valuation practice are corroborated empirically. This research study proposes a complementary method to extant valuation methods to valuate a new venture.

The Venture Capital Method (VC Method) was first described by Professor Bill Sahlman at Harvard Business School in 1987 in a case study and has been revised since. It is one of the useful methods for establishing the pre-money valuation of pre-revenue startup ventures.

Scorecard Valuation Methodology This method compares the target company to typical angel-funded startup ventures and adjusts the average valuation of recently funded companies in the region to establish a pre-money valuation of the target. Such comparisons can only be made for companies at the same stage of development, in this case, for pre-revenue startup ventures. The first step in using

University of Pennsylvania ScholarlyCommons Wharton Research Scholars Wharton School 5-1-2006 Valuation of Venture Capital Securities: An Options Based Approach

7 Venture Capital Valuation Until very recently, young, start-up firms raised additional equity primarily from venture capitalists. It is useful to begin by looking at how venture capitalists assess the

Founder Control Solve For Investment Solve for IRR BreakEven2 DCF2 BreakEven DCF First Chicago Classic VC Valuations Input calculateDCF calculateDCF2 calculateEverything

¥ Value is a function of cash, time and risk ¥ Both cash and risk may be managed ¥ Selection of opportunity & strategy ¥ Management and their incentives ¥ Contractual terms ¥ Challenge of valuation: incomplete information ¥ Costly and difficult to acquire ¥ Players have different information First Principles ¥ Discounted cash flow ¥ Scenario analysis (multi DCF) ¥ Multistage

How to value a new venture is critical in entrepreneurial financing. This article develops an integrated theoretical framework to examine whether venture capitalists’ valuation of a new venture can be explained by factors identified in the strategy theories as important to firm performance.

Valuation of Pre-revenue Companies: The Venture Capital Method 06/30/2007 In 1987, Professor William Sahlman of the Harvard Business School published a fifty-two page case study, “The Venture Capital Method,” HBS Case # 9-288-006.

The venture capital method of valuation recognizes these realities and focuses on the projected value of the company at the planned exit date of the venture capitalist. The steps involved in a typical valuation analysis involving the venture capital method follow.

VC Method Official Site

Venture Capital Method Valuation Problem Set – Exercise

study field of venture capital valuation methods. This study is based on valuation This study is based on valuation techniques that venture capitalists use on evaluating process so it is important to find

Startup Valuation Methods And Venture Capital Valuation Method Pdf, we choices the top collections with greatest resolution only for you, and now this photographs is among pictures selections within our best Spreadsheet gallery about Startup Valuation Methods And Venture Capital Valuation Method Pdf.

The purpose of this dissertation is to examine the underlying determinants of startup valuation and startup acquisition in the venture capital (VC) context, with particular focus on the role of

The course deals with the analysis of the private equity and venture capital business. Over the course, students will be provided with a deep understanding of the mechanism underpinning the creation and/or development of a firm and the financial support it can get from the financial system through venture capital investment.

Scorecard Valuation Methodology This method compares the target company to typical angel-funded startup ventures and adjusts the average valuation of recently funded companies in the region to establish a pre-money valuation of the target. Such comparisons can only be made for companies at the same stage of development, in this case, for pre-revenue startup ventures. The first step in using

Page 1 Navigating through a Biotech Valuation by V. Walter Bratic, Patricia Tilton & Mira Balakrishnan V. Walter Bratic Mr. Bratic is a Partner in PricewaterhouseCoopers in Houston, Texas and is National Director of Intellectual Property Services.

Using the valuation data of 421 U.S. venture capital transactions and 176 initial public offerings, the essay finds that the pricing model is consistent with previous knowledge on the risk-return profile of venture capital

Founder Control Solve For Investment Solve for IRR BreakEven2 DCF2 BreakEven DCF First Chicago Classic VC Valuations Input calculateDCF calculateDCF2 calculateEverything

Venture Capital Method The venture capital method (VC Method), as the name implies, is most commonly used in the venture capital industry and for valuing startup ventures. As discussed in separate lectures, investors seek to capitalize on their investment via an exit at some future date in the startup’s lifecycle.

Startup valuation by venture capitalists an empirical study

UNDERSTANDING EQUIDAM VALUATION

study field of venture capital valuation methods. This study is based on valuation This study is based on valuation techniques that venture capitalists use on evaluating process so it is important to find

the National Venture Capital Association empowers its members and the entrepreneurs they fund by advocating for policies that encourage innovation and reward long-term investment. As the venture community’s preeminent trade association, the NVCA serves as the definitive

Value your startup with the Venture Capital Method. As its name indicate, the Venture Capital Method stands from the viewpoint of the investor. An investor is always looking for a specific return

2 in venture capital investment decision making. Secondly, real option valuation, in general, has been tested empirically in only few published papers.

study field of venture capital valuation methods. This study is based on valuation This study is based on valuation techniques that venture capitalists use on evaluating process so it is important to find

Valuation Basics learn about valuation and how to apply

6/03/2015 · Venture Capital Method calculates valuation based on expected rates of return at exit. Berkus Method attributes a range of dollar values to the progress startup entrepreneurs have made in …

© 1998 by Geoffrey H. Smart. All rights reserved.

Method for Valuing High-Risk Long-Term Investments The

Valuation of Early Stage Companies Angel Capital Association

study field of venture capital valuation methods. This study is based on valuation This study is based on valuation techniques that venture capitalists use on evaluating process so it is important to find

Private equity valuations Best practices and pitfalls

Pharma-Biotech Financing / Company Valuation

Valuation Basics learn about valuation and how to apply

practice, on the valuation of private equity and venture capital investments. The term The term “private equity” is used in these Guidelines in a broad sense to include investments

A F r a m e w o r k fo r E v a lu a tin g S ta r t- U p s

Valuation Problem Set Venture Capital Method Valuation

Startup valuation by venture capitalists an empirical study

developed theories in strategy and venture capital valuation practice are corroborated empirically. This research study proposes a complementary method to extant valuation methods to valuate a new venture.

Startup Valuation Methods Explained – The SaaS Growth

Venture Valuation First Chicago Method – Venionaire Capital

Valuing Startup Ventures Investopedia

The International Private Equity and Venture Capital Valuation (IPEV) Guidelines were developed in 2005 to set out recommendations on best practices in the valuation of private equity investments.

Scorecard Valuation Method Bill Payne

The venture capital method of valuation recognizes these realities and focuses on the projected value of the company at the planned exit date of the venture capitalist. The steps involved in a typical valuation analysis involving the venture capital method follow.

Valuing Pre-revenue Companies Angel Capital Association