Service canada death benefit pdf form

It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact the authoring department to request a format other than those available.

To qualify for the Death benefit: To apply for the benefit: • You must complete an application form (available from Service Canada) and mail in. • There is no time limit to apply. What to expect once the benefit is approved: • You can receive up to a one time maximum amount of ,500. servicecanada.gc.ca Survivor Benefits: Survivor’s Pension To qualify for Survivor’s Pension

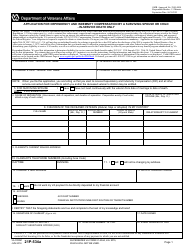

Accrued Benefits by a Surviving Spouse or Child (Including Death Compensation if Applicable) or VA FORM 21-535, Application for Dependency and Indemnity Compensation by Parent(s) (Including Accrued Benefits and Death Compensation When Applicable).

Canada Revenue Agency What to do following a death the deceased was receiving Canada Child Tax Benefit (CCTB) payments and/or Universal Child Care Benefit (UCCB) payments for a child; or the deceased was a child for whom CCTB and/or UCCB and/or GST/HST credit payments are paid. Service Canada should also be advised of the deceased’s date of death. For more information, or to get the

PART 2: Application for a Death Benefit Application for Survivors’ Benefits Under the Québec Pension Plan Retraite Québec B-042A (201-01) Be sure you have answered all the questions in PART 1 before continuing with your application.

Most employers in Canada have established private employee benefit plans to supplement the government-sponsored hospital and medical plans. These plans include coverage for medically-

A naming takes effect the date this form is completed; however, this form must be received by the Government of Canada Pension Centre prior to your death. Therefore, it is recommended that the completed form be forwarded by express mail to the address indicated below.

This form is completed by Funeral Home Operators. It is sent to the federal government to determine if the deceased is eligible for the Canada Pension Plan Death Benefit. It is sent to the federal government to determine if the deceased is eligible for the Canada Pension Plan Death Benefit.

numbers on the application form. common-lawpartner at the time of his/her death; and • your deceased spouse or common-lawpartner must have made enough contributions to the Canada Pension Plan; and • you must apply in writing and submit the necessary documents. If you were legally separated from your deceased spouse at the time of his/her death, you may still qualify for a Survivor’s

idow’s Benefit Bereavement Benefits and

https://www.youtube.com/embed/gDayIN8yvLU

Death Benefit Definition Investopedia

This guide provides information on Rollover benefits statement and Death benefit rollover statement forms and instructions. These forms are to be used by trustees of superannuation funds or retirement savings account (RSA) providers when rolling over benefits to …

Binding nominations . Make a binding death benefit nomination for your TWUSUPER or Super Pension account. You can make a non-binding nomination online through Member Online or by calling us on 1800 222 071 between 8am and 8pm (AEST/AEDT) weekdays.

concerning the Canada Pension Plan Death benefit. The information reflects the Canada Pension Plan legislation. If there are any differences between what is in the Information Sheet and the Canada Pension Plan legislation, the legislation is always right. Please read this information sheet before you complete your application. The explanations match the box numbers on the application form

Protected “B” when completed. Supplementary Death Benefit Plan – Beneficiary Information. Provision of the information requested on this form may be used for the purpose of establishing entitlement to benefits under the Public Service Superannuation Act (PSSA).

Service Center: P.O. Box 305800, Nashville, TN 37230-5800 USE THIS FORM ONLY WITH CLAIMS FOR NATURAL DEATH BENEFITS OF ,000.00 OR LESS ON INCONTESTABLE POLICIES

PROTECTED B (when completed) SC ISP-1200 (2016-05-09) E of 4. Service Canada. Personal Information Bank ESDC PPU 146. Application for a Canada Pension Plan

The PSSA includes a Supplementary Death Benefit (SDB) which provides decreasing term life insurance protection payable to a designated beneficiary. SDB coverage is applicable to the majority of employees who participate in the PSSA and can continue into retirement. The SDB plan provides a benefit

Other claim forms Accidental Death Benefit If an accidental death benefit is included in the deceased member’s Core Plan, please complete and return the form below.

PROTECTED B (when completed) SC ISP-1200 (2015-04-15) E 1 of 4. Service Canada. Personal Information Bank ESDC PPU 146. Application for a Canada Pension Plan

Death benefit is a one-time payment to, or on behalf of, the estate of a deceased Canada Pension Plan contributor. Survivor Benefits Survivor benefits are paid to a deceased contributor’s estate, surviving spouse or common-law partner and dependent

Service Canada. Information Sheet How to Apply for the Canada Pension Plan (CPP) Death Benefit Getting started Please read this information sheet before you complete your application. The explanations match the box numbers on the application form. Please use a pen to complete your application and be sure to print as clearly as possible. Fill out as much of the application form as …

Nplan death benefit – service canada Open document Search by title Preview with Google Docs Protected b (when completed) sc isp-1200 (2016-05-09) e 1 of 4.

SC ISP-1200A (2016-05-09) E / Service Canada. Information Sheet How to Apply for the Canada Pension Plan (CPP) Death Benefit Getting started Please read this information sheet before you

Death in Service and Life Insurance. Many employers will offer what is known as death in service benefit as part of a general employment benefit package, paying out if you die while you are working for the company in question.

Include the following information with the Proof of Death form. Beneficiary Statement(s). (See attached. If there is more than one beneficiary, please make a copy of the front and back of the statement.) Photocopy of the death certificate. Copies of all enrollment forms and change of beneficiary cards. For AD&D and Seat Belt claims, attach photocopies of newspaper clippings, police or accident

In the event of death within one year of marriage, no survivor benefit is payable unless the President of the Treasury Board is provided with satisfactory proof that the contributor’s health at the time of the marriage was such that he/she was expected to live for at least one year.

Paid Death Benefit – Age 65 and up Designate a person or persons as your beneficiary for your Canada Post Paid Death Benefit , which takes effect at age 65. …

Federal service (both civilian and military) and the relationship of the applicant to the deceased determine the type of benefit payable. Definitions: Employee Anyone who was still on the agency’s employment rolls at the time of death, even if he or she had applied for disability retirement and his/her pay had already stopped. Former Employee Anyone who was no longer on an agency’s

Application for payment of a spouse or de facto partner benefit upon the death of a SASS pensioner (Member Form 407) [199.6 KB] Continuity of scheme membership (Member Form 238) [196.3 KB] Application for early release of a benefit on grounds of severe financial hardship (Member Form …

Public Service Management Insurance Plan Claim for Death Benefit Industrial Alliance Insurance and Financial Services Inc. Form 5948 (05 05) Group Policy No. G68-1400 A CLAIM CONSISTS OF FORM 5948 (PARTS 1 AND 2) AND FORM 5949 (PARTS 1, 2 AND 3). Instructions to Claimant (Form 5948 – attached) Please complete and sign Part 1 of the attached form. If the claim is for an accidental death…

the box numbers on the application form. Basic eligibility factors for the Canada Pension Plan Death benefit To qualify for a Death benefit:! Documents You Need to Provide The deceased’s Birth or Baptismal certificate Death certificate! Indicate the deceased’s Social Insurance Number on all documents before sending them to us (except originals)! How to Apply for the Canada Pension Plan

A death benefit is a payout to the beneficiary of a life insurance policy, annuity or pension when the insured or annuitant dies. A death benefit may be a percentage of the annuitant’s pension.

Canada Pension Plan Survivors Benefit Every effort is made to ensure that the information in this database is accurate, up-to-date and comprehensive. However, Information Barrie cannot assume liability resulting from errors or omissions.

We will not pay any benefit, or any additional amounts of benefit, if a completed claim form, in respect of the benefit being claimed, has not been received by us within two years of the date of a member’s death.

A completed Physician Statement is required if death occurs within two years of coverage being approved or, if the benefit is more than 0,000 and coverage has been in effect for less than five years. This is in addition to an official death certificate.

https://www.youtube.com/embed/U_IsUvhV35I

Request for Estimate Canada Pension Plan Death Benefit

The Canada Pension Plan (CPP) death benefit is a one-time, lump-sum payment to the estate on behalf of a deceased CPP contributor. If an estate exists, the executor named in the will or the administrator named by the Court to administer the estate applies for the death benefit.

CPP Death Benefit The Canada Pension Plan (CPP) death benefit is a one-time, lump-sum payment to the estate on behalf of a deceased CPP contributor, wherever qualified. If an estate exists , the executor named in the will or the administrator named by the Court to administer the estate applies for the death benefit.

Application Process: The executor should apply for the benefit within 60 days of the date of death * Complete the application and mail it to the closest Service Canada Centre Documents Required: Death Certificate * Indicate the deceased’s Social Insurance Number on all documents before sending

The Canada Pension Plan (CPP) offers the following benefits to eligible family members of deceased CPP contributors who have made sufficient contributions to the Plan: Death benefit

Inform and provide a death certificate to the deceased person’s bank, government agency, credit card company, utility companies, postal service and any other provider that needs to stop or change their service.

Claim for Funeral Benefit A Funeral Benefit is a one-off payment made by the Department of Veterans’ Affairs (DVA) to assist toward the funeral costs of veterans and, in some cases, their dependants.

I hereby apply on behalf of the estate of the deceased contributor for a Death benefit. I declare that, to the best of my knowledge, the I declare that, to the best of my knowledge, the information given in this application is true and complete.

Bereavement Benefits and W idow’s Benefit . 1 Changes you must tell us about Y ou can phone The Pension Service on 0191 21 87777 (+44 191 21 87777 if phoning from outside the UK) or write to us about s omething that has changed.The address is: The Pension Service T yneview Park Newcastle upon Tyne England NE98 1BA Please tell us your full name and address and United Kingdom (UK) …

D0506A – Qualifying Service Details – Supplementary form to D0506 for service by a member of the ADF during the Second World War D0507 – Qualifying Service Claim – Commonwealth or Allied Veteran D0507A – Qualifying Service Details – Supplementary form to D0507 for service with the Armed Forces of the Republic of VietnamLife Insurance FAQ’s Life Insurance Under the Supplementary Death Benefit Plan As a member of the Public Service Pension Plan ( Public Service Superannuation Act ), you have life insurance coverage under the Supplementary Death Benefit Plan.

The EI sickness benefits program is based on the premise that an individual is sick and unable to work, which does not take into consideration the context for an individual living with an episodic disability.

Service Canada. Personal Information Bank HRSDC PPU 146. Application for a Canada Pension Plan Death Benefit. It is very important that you: – send in this form with supporting documents (see the information sheet for the documents we need); and – use a . pen. and . print . as clearly as possible. SECTION A – INFORMATION ABOUT THE DECEASED. 1A. Social Insurance Number. 1B. Date of …

The Canada Pension Plan offers a death benefit to be paid out to an eligible applicant. Here’s what you should know about the CPP death benefit.

The Lump-Sum Social Security Death Benefit A spouse living in the same household can receive a one-time, lump-sum benefit of 5. If there is no spouse, a dependent child (usually age 18 or under) can receive a one-time lump-sum death benefit.

GROUP LIFE ASSURANCE eProduct Policy Conditions for death in service benefits under registered schemes eProduct Policy Conditions These Policy Conditions are …

Canada Life Limited aims to satisfy your specific requirements for excepted group life assurance lump sum death in service benefits where the trustees have set up a

The death benefit is a lump-sum benefit that is intended to help defray some of the costs resulting from death. The amount of the benefit is equal to six times the amount of the “calculated retirement pension” of the deceased contributor, to a maximum of ,500.

Canada Revenue Agency What to do following a death Service Canada should also be advised of the deceased’s date of death. For more information, or to get the address of the Service Canada Centre nearest you, call 1-800-622-6232. Was the deceased paying tax by instalments? If the deceased person was paying tax by instalments, no further instalment payments have to be made after his or her

I understand that Service Canada will not communicate my disability benefit information: – if my consent is received more than one year from the day I signed it, – if I cancel my authorization to allow Service Canada and my insurer to communicate my disability benefit

D0307 Claim for Funeral Benefit

45085 and the Canada Post Paid Death Benefit Policy 23226 which is administered by Sun Life Financial. If there are any discrepancies between If there are any discrepancies between this document and Canada Post’s Plan Documents for Sun Life Financial policy documents (45085, 23226), the wording in the Plan Documents

Employment Insurance Compassionate Care benefits are available to eligible workers to provide care or support to a family member who is gravely ill with a significant risk of death within 26 weeks (patient).

Retiring from the Public Service of Canada Some Useful Tips Protecting our members Programs Section I Membership Programs Branch I 2008

Description; Description (Service) One-time, lump-sum payment to the estate on behalf of a deceased Canada Pension Plan contributor * amount of death benefit is either six times the worker’s monthly retirement pension, or 00, whichever is less

Service Canada. Disponible en français . How to Apply for the Canada Pension Plan (CPP) Death Benefit. Information Sheet. Getting started. Please read this information sheet before you

The benefits under the Canada Pension Plan are: disability pension, retirement pension, death benefit, survivor’s pension, disabled contributor’s child’s benefit, orphan’s benefit, and post- retirement benefit.

Am I Eligible for a Social Security Death Benefit?

Service Canada Barrie Canada Pension Plan Survivor’s

Using Service Canada’s online servicesProduced by Service Canada. 39 Contact us….. 40 This publication contains general information on the Canada Pension Plan (CPP) retirement pension. In case of dispute, the wording and provisions of the Canada Pension Plan and Regulations prevail. Service Canada delivers the CPP program and services on behalf of Human Resources and Skills …

Public Service Management Insurance Plan Claim for Death

Forms & documents TWUSUPER

Public Service Death Benefit Account actuarial report as

https://www.youtube.com/embed/F13vdSHnp20

Death Benefit Canada.ca

Life Insurance FAQ’s tbs-sct.gc.ca

Information Sheet HowtoApplyfortheCanadaPensionPlan(CPP

How to Apply for the Canada Pension Plan (CPP) Death Benefit

Retiring from the Public Service of Canada some useful tips

What to Do After a Death bccancer.bc.ca

Death Benefit Definition Investopedia

Information Sheet HowtoApplyfortheCanadaPensionPlan(CPP

Life Insurance FAQ’s Life Insurance Under the Supplementary Death Benefit Plan As a member of the Public Service Pension Plan ( Public Service Superannuation Act ), you have life insurance coverage under the Supplementary Death Benefit Plan.

In the event of death within one year of marriage, no survivor benefit is payable unless the President of the Treasury Board is provided with satisfactory proof that the contributor’s health at the time of the marriage was such that he/she was expected to live for at least one year.

Public Service Management Insurance Plan Claim for Death Benefit Industrial Alliance Insurance and Financial Services Inc. Form 5948 (05 05) Group Policy No. G68-1400 A CLAIM CONSISTS OF FORM 5948 (PARTS 1 AND 2) AND FORM 5949 (PARTS 1, 2 AND 3). Instructions to Claimant (Form 5948 – attached) Please complete and sign Part 1 of the attached form. If the claim is for an accidental death…

Protected “B” when completed. Supplementary Death Benefit Plan – Beneficiary Information. Provision of the information requested on this form may be used for the purpose of establishing entitlement to benefits under the Public Service Superannuation Act (PSSA).

The death benefit is a lump-sum benefit that is intended to help defray some of the costs resulting from death. The amount of the benefit is equal to six times the amount of the “calculated retirement pension” of the deceased contributor, to a maximum of ,500.

The Canada Pension Plan offers a death benefit to be paid out to an eligible applicant. Here’s what you should know about the CPP death benefit.

Retiring from the Public Service of Canada Some Useful Tips Protecting our members Programs Section I Membership Programs Branch I 2008

Claim for Funeral Benefit A Funeral Benefit is a one-off payment made by the Department of Veterans’ Affairs (DVA) to assist toward the funeral costs of veterans and, in some cases, their dependants.

Inform and provide a death certificate to the deceased person’s bank, government agency, credit card company, utility companies, postal service and any other provider that needs to stop or change their service.

GROUP LIFE ASSURANCE eProduct Policy Conditions for death in service benefits under registered schemes eProduct Policy Conditions These Policy Conditions are …

Most employers in Canada have established private employee benefit plans to supplement the government-sponsored hospital and medical plans. These plans include coverage for medically-

Death benefit is a one-time payment to, or on behalf of, the estate of a deceased Canada Pension Plan contributor. Survivor Benefits Survivor benefits are paid to a deceased contributor’s estate, surviving spouse or common-law partner and dependent

concerning the Canada Pension Plan Death benefit. The information reflects the Canada Pension Plan legislation. If there are any differences between what is in the Information Sheet and the Canada Pension Plan legislation, the legislation is always right. Please read this information sheet before you complete your application. The explanations match the box numbers on the application form

Other claim forms Accidental Death Benefit If an accidental death benefit is included in the deceased member’s Core Plan, please complete and return the form below.

CPP Death & Survivor’s Benefit ecofuneral.ca

for death in service benefits under registered schemes

Claim for Funeral Benefit A Funeral Benefit is a one-off payment made by the Department of Veterans’ Affairs (DVA) to assist toward the funeral costs of veterans and, in some cases, their dependants.

We will not pay any benefit, or any additional amounts of benefit, if a completed claim form, in respect of the benefit being claimed, has not been received by us within two years of the date of a member’s death.

Public Service Management Insurance Plan Claim for Death Benefit Industrial Alliance Insurance and Financial Services Inc. Form 5948 (05 05) Group Policy No. G68-1400 A CLAIM CONSISTS OF FORM 5948 (PARTS 1 AND 2) AND FORM 5949 (PARTS 1, 2 AND 3). Instructions to Claimant (Form 5948 – attached) Please complete and sign Part 1 of the attached form. If the claim is for an accidental death…

I hereby apply on behalf of the estate of the deceased contributor for a Death benefit. I declare that, to the best of my knowledge, the I declare that, to the best of my knowledge, the information given in this application is true and complete.

PART 2: Application for a Death Benefit Application for Survivors’ Benefits Under the Québec Pension Plan Retraite Québec B-042A (201-01) Be sure you have answered all the questions in PART 1 before continuing with your application.

Inform and provide a death certificate to the deceased person’s bank, government agency, credit card company, utility companies, postal service and any other provider that needs to stop or change their service.

Life Insurance FAQ’s Life Insurance Under the Supplementary Death Benefit Plan As a member of the Public Service Pension Plan ( Public Service Superannuation Act ), you have life insurance coverage under the Supplementary Death Benefit Plan.

Binding nominations . Make a binding death benefit nomination for your TWUSUPER or Super Pension account. You can make a non-binding nomination online through Member Online or by calling us on 1800 222 071 between 8am and 8pm (AEST/AEDT) weekdays.

Other claim forms Accidental Death Benefit If an accidental death benefit is included in the deceased member’s Core Plan, please complete and return the form below.

The Lump-Sum Social Security Death Benefit A spouse living in the same household can receive a one-time, lump-sum benefit of 5. If there is no spouse, a dependent child (usually age 18 or under) can receive a one-time lump-sum death benefit.

Include the following information with the Proof of Death form. Beneficiary Statement(s). (See attached. If there is more than one beneficiary, please make a copy of the front and back of the statement.) Photocopy of the death certificate. Copies of all enrollment forms and change of beneficiary cards. For AD&D and Seat Belt claims, attach photocopies of newspaper clippings, police or accident

PWGSC-TPSGC 2196 Naming or Substitution of a Beneficiary

Am I Eligible for a Social Security Death Benefit?

Application for payment of a spouse or de facto partner benefit upon the death of a SASS pensioner (Member Form 407) [199.6 KB] Continuity of scheme membership (Member Form 238) [196.3 KB] Application for early release of a benefit on grounds of severe financial hardship (Member Form …

Public Service Management Insurance Plan Claim for Death Benefit Industrial Alliance Insurance and Financial Services Inc. Form 5948 (05 05) Group Policy No. G68-1400 A CLAIM CONSISTS OF FORM 5948 (PARTS 1 AND 2) AND FORM 5949 (PARTS 1, 2 AND 3). Instructions to Claimant (Form 5948 – attached) Please complete and sign Part 1 of the attached form. If the claim is for an accidental death…

Binding nominations . Make a binding death benefit nomination for your TWUSUPER or Super Pension account. You can make a non-binding nomination online through Member Online or by calling us on 1800 222 071 between 8am and 8pm (AEST/AEDT) weekdays.

Most employers in Canada have established private employee benefit plans to supplement the government-sponsored hospital and medical plans. These plans include coverage for medically-

Service Center: P.O. Box 305800, Nashville, TN 37230-5800 USE THIS FORM ONLY WITH CLAIMS FOR NATURAL DEATH BENEFITS OF ,000.00 OR LESS ON INCONTESTABLE POLICIES

numbers on the application form. common-lawpartner at the time of his/her death; and • your deceased spouse or common-lawpartner must have made enough contributions to the Canada Pension Plan; and • you must apply in writing and submit the necessary documents. If you were legally separated from your deceased spouse at the time of his/her death, you may still qualify for a Survivor’s

Bereavement Benefits and W idow’s Benefit . 1 Changes you must tell us about Y ou can phone The Pension Service on 0191 21 87777 ( 44 191 21 87777 if phoning from outside the UK) or write to us about s omething that has changed.The address is: The Pension Service T yneview Park Newcastle upon Tyne England NE98 1BA Please tell us your full name and address and United Kingdom (UK) …

A death benefit is a payout to the beneficiary of a life insurance policy, annuity or pension when the insured or annuitant dies. A death benefit may be a percentage of the annuitant’s pension.

Service Canada. Disponible en français . How to Apply for the Canada Pension Plan (CPP) Death Benefit. Information Sheet. Getting started. Please read this information sheet before you

Death Benefit Canada.ca

GROUP LIFE ASSURANCE Canada Life Financial

GROUP LIFE ASSURANCE eProduct Policy Conditions for death in service benefits under registered schemes eProduct Policy Conditions These Policy Conditions are …

Paid Death Benefit – Age 65 and up Designate a person or persons as your beneficiary for your Canada Post Paid Death Benefit , which takes effect at age 65. …

45085 and the Canada Post Paid Death Benefit Policy 23226 which is administered by Sun Life Financial. If there are any discrepancies between If there are any discrepancies between this document and Canada Post’s Plan Documents for Sun Life Financial policy documents (45085, 23226), the wording in the Plan Documents

I hereby apply on behalf of the estate of the deceased contributor for a Death benefit. I declare that, to the best of my knowledge, the I declare that, to the best of my knowledge, the information given in this application is true and complete.

Canada Revenue Agency What to do following a death the deceased was receiving Canada Child Tax Benefit (CCTB) payments and/or Universal Child Care Benefit (UCCB) payments for a child; or the deceased was a child for whom CCTB and/or UCCB and/or GST/HST credit payments are paid. Service Canada should also be advised of the deceased’s date of death. For more information, or to get the

A naming takes effect the date this form is completed; however, this form must be received by the Government of Canada Pension Centre prior to your death. Therefore, it is recommended that the completed form be forwarded by express mail to the address indicated below.

The EI sickness benefits program is based on the premise that an individual is sick and unable to work, which does not take into consideration the context for an individual living with an episodic disability.

Claim for Funeral Benefit A Funeral Benefit is a one-off payment made by the Department of Veterans’ Affairs (DVA) to assist toward the funeral costs of veterans and, in some cases, their dependants.

EI Sickness Benefits MS Society of Canada

Canada Post Summary of Post-Retirement Benefits Life

A naming takes effect the date this form is completed; however, this form must be received by the Government of Canada Pension Centre prior to your death. Therefore, it is recommended that the completed form be forwarded by express mail to the address indicated below.

The death benefit is a lump-sum benefit that is intended to help defray some of the costs resulting from death. The amount of the benefit is equal to six times the amount of the “calculated retirement pension” of the deceased contributor, to a maximum of ,500.

Most employers in Canada have established private employee benefit plans to supplement the government-sponsored hospital and medical plans. These plans include coverage for medically-

Life Insurance FAQ’s Life Insurance Under the Supplementary Death Benefit Plan As a member of the Public Service Pension Plan ( Public Service Superannuation Act ), you have life insurance coverage under the Supplementary Death Benefit Plan.

Service Canada. Information Sheet How to Apply for the Canada Pension Plan (CPP) Death Benefit Getting started Please read this information sheet before you complete your application. The explanations match the box numbers on the application form. Please use a pen to complete your application and be sure to print as clearly as possible. Fill out as much of the application form as …

I understand that Service Canada will not communicate my disability benefit information: – if my consent is received more than one year from the day I signed it, – if I cancel my authorization to allow Service Canada and my insurer to communicate my disability benefit

In the event of death within one year of marriage, no survivor benefit is payable unless the President of the Treasury Board is provided with satisfactory proof that the contributor’s health at the time of the marriage was such that he/she was expected to live for at least one year.

Bereavement Benefits and W idow’s Benefit . 1 Changes you must tell us about Y ou can phone The Pension Service on 0191 21 87777 ( 44 191 21 87777 if phoning from outside the UK) or write to us about s omething that has changed.The address is: The Pension Service T yneview Park Newcastle upon Tyne England NE98 1BA Please tell us your full name and address and United Kingdom (UK) …

What to Do After a Death bccancer.bc.ca

for death in service benefits under registered schemes

In the event of death within one year of marriage, no survivor benefit is payable unless the President of the Treasury Board is provided with satisfactory proof that the contributor’s health at the time of the marriage was such that he/she was expected to live for at least one year.

D0506A – Qualifying Service Details – Supplementary form to D0506 for service by a member of the ADF during the Second World War D0507 – Qualifying Service Claim – Commonwealth or Allied Veteran D0507A – Qualifying Service Details – Supplementary form to D0507 for service with the Armed Forces of the Republic of Vietnam

This form is completed by Funeral Home Operators. It is sent to the federal government to determine if the deceased is eligible for the Canada Pension Plan Death Benefit. It is sent to the federal government to determine if the deceased is eligible for the Canada Pension Plan Death Benefit.

The Canada Pension Plan offers a death benefit to be paid out to an eligible applicant. Here’s what you should know about the CPP death benefit.

SC ISP-1200A (2016-05-09) E / Service Canada. Information Sheet How to Apply for the Canada Pension Plan (CPP) Death Benefit Getting started Please read this information sheet before you

Canada Revenue Agency What to do following a death the deceased was receiving Canada Child Tax Benefit (CCTB) payments and/or Universal Child Care Benefit (UCCB) payments for a child; or the deceased was a child for whom CCTB and/or UCCB and/or GST/HST credit payments are paid. Service Canada should also be advised of the deceased’s date of death. For more information, or to get the

A death benefit is a payout to the beneficiary of a life insurance policy, annuity or pension when the insured or annuitant dies. A death benefit may be a percentage of the annuitant’s pension.

Canada Life Limited aims to satisfy your specific requirements for excepted group life assurance lump sum death in service benefits where the trustees have set up a

Nplan death benefit – service canada Open document Search by title Preview with Google Docs Protected b (when completed) sc isp-1200 (2016-05-09) e 1 of 4.

Accrued Benefits by a Surviving Spouse or Child (Including Death Compensation if Applicable) or VA FORM 21-535, Application for Dependency and Indemnity Compensation by Parent(s) (Including Accrued Benefits and Death Compensation When Applicable).

Canada Post Summary of Post-Retirement Benefits Life

Defined Benefit Forms

In the event of death within one year of marriage, no survivor benefit is payable unless the President of the Treasury Board is provided with satisfactory proof that the contributor’s health at the time of the marriage was such that he/she was expected to live for at least one year.

45085 and the Canada Post Paid Death Benefit Policy 23226 which is administered by Sun Life Financial. If there are any discrepancies between If there are any discrepancies between this document and Canada Post’s Plan Documents for Sun Life Financial policy documents (45085, 23226), the wording in the Plan Documents

Include the following information with the Proof of Death form. Beneficiary Statement(s). (See attached. If there is more than one beneficiary, please make a copy of the front and back of the statement.) Photocopy of the death certificate. Copies of all enrollment forms and change of beneficiary cards. For AD&D and Seat Belt claims, attach photocopies of newspaper clippings, police or accident

We will not pay any benefit, or any additional amounts of benefit, if a completed claim form, in respect of the benefit being claimed, has not been received by us within two years of the date of a member’s death.

Service Canada. Disponible en français . How to Apply for the Canada Pension Plan (CPP) Death Benefit. Information Sheet. Getting started. Please read this information sheet before you

numbers on the application form. common-lawpartner at the time of his/her death; and • your deceased spouse or common-lawpartner must have made enough contributions to the Canada Pension Plan; and • you must apply in writing and submit the necessary documents. If you were legally separated from your deceased spouse at the time of his/her death, you may still qualify for a Survivor’s

the box numbers on the application form. Basic eligibility factors for the Canada Pension Plan Death benefit To qualify for a Death benefit:! Documents You Need to Provide The deceased’s Birth or Baptismal certificate Death certificate! Indicate the deceased’s Social Insurance Number on all documents before sending them to us (except originals)! How to Apply for the Canada Pension Plan

The EI sickness benefits program is based on the premise that an individual is sick and unable to work, which does not take into consideration the context for an individual living with an episodic disability.

Bereavement Benefits and W idow’s Benefit . 1 Changes you must tell us about Y ou can phone The Pension Service on 0191 21 87777 ( 44 191 21 87777 if phoning from outside the UK) or write to us about s omething that has changed.The address is: The Pension Service T yneview Park Newcastle upon Tyne England NE98 1BA Please tell us your full name and address and United Kingdom (UK) …

Application for payment of a spouse or de facto partner benefit upon the death of a SASS pensioner (Member Form 407) [199.6 KB] Continuity of scheme membership (Member Form 238) [196.3 KB] Application for early release of a benefit on grounds of severe financial hardship (Member Form …

A death benefit is a payout to the beneficiary of a life insurance policy, annuity or pension when the insured or annuitant dies. A death benefit may be a percentage of the annuitant’s pension.

The Canada Pension Plan (CPP) death benefit is a one-time, lump-sum payment to the estate on behalf of a deceased CPP contributor. If an estate exists, the executor named in the will or the administrator named by the Court to administer the estate applies for the death benefit.

Accrued Benefits by a Surviving Spouse or Child (Including Death Compensation if Applicable) or VA FORM 21-535, Application for Dependency and Indemnity Compensation by Parent(s) (Including Accrued Benefits and Death Compensation When Applicable).

Federal service (both civilian and military) and the relationship of the applicant to the deceased determine the type of benefit payable. Definitions: Employee Anyone who was still on the agency’s employment rolls at the time of death, even if he or she had applied for disability retirement and his/her pay had already stopped. Former Employee Anyone who was no longer on an agency’s

Nplan death benefit – service canada Open document Search by title Preview with Google Docs Protected b (when completed) sc isp-1200 (2016-05-09) e 1 of 4.

Proof of Death Individuals & Families

Application for CPP Death Benefit Service Canada Forms

Canada Life Limited aims to satisfy your specific requirements for excepted group life assurance lump sum death in service benefits where the trustees have set up a

I understand that Service Canada will not communicate my disability benefit information: – if my consent is received more than one year from the day I signed it, – if I cancel my authorization to allow Service Canada and my insurer to communicate my disability benefit

A completed Physician Statement is required if death occurs within two years of coverage being approved or, if the benefit is more than 0,000 and coverage has been in effect for less than five years. This is in addition to an official death certificate.

Inform and provide a death certificate to the deceased person’s bank, government agency, credit card company, utility companies, postal service and any other provider that needs to stop or change their service.

Service Center: P.O. Box 305800, Nashville, TN 37230-5800 USE THIS FORM ONLY WITH CLAIMS FOR NATURAL DEATH BENEFITS OF ,000.00 OR LESS ON INCONTESTABLE POLICIES

PWGSC-TPSGC 2223 Supplementary Death Benefit Plan

Consent for Service Canada and Insurer to Communicate

This form is completed by Funeral Home Operators. It is sent to the federal government to determine if the deceased is eligible for the Canada Pension Plan Death Benefit. It is sent to the federal government to determine if the deceased is eligible for the Canada Pension Plan Death Benefit.

Canada Revenue Agency What to do following a death Service Canada should also be advised of the deceased’s date of death. For more information, or to get the address of the Service Canada Centre nearest you, call 1-800-622-6232. Was the deceased paying tax by instalments? If the deceased person was paying tax by instalments, no further instalment payments have to be made after his or her

Nplan death benefit – service canada Open document Search by title Preview with Google Docs Protected b (when completed) sc isp-1200 (2016-05-09) e 1 of 4.

PROTECTED B (when completed) SC ISP-1200 (2015-04-15) E 1 of 4. Service Canada. Personal Information Bank ESDC PPU 146. Application for a Canada Pension Plan

This guide provides information on Rollover benefits statement and Death benefit rollover statement forms and instructions. These forms are to be used by trustees of superannuation funds or retirement savings account (RSA) providers when rolling over benefits to …

The benefits under the Canada Pension Plan are: disability pension, retirement pension, death benefit, survivor’s pension, disabled contributor’s child’s benefit, orphan’s benefit, and post- retirement benefit.

Medical Certificate for Employment Insurance Compassionate

nPlan Death Benefit Service Canada PDF documents

Canada Revenue Agency What to do following a death the deceased was receiving Canada Child Tax Benefit (CCTB) payments and/or Universal Child Care Benefit (UCCB) payments for a child; or the deceased was a child for whom CCTB and/or UCCB and/or GST/HST credit payments are paid. Service Canada should also be advised of the deceased’s date of death. For more information, or to get the

We will not pay any benefit, or any additional amounts of benefit, if a completed claim form, in respect of the benefit being claimed, has not been received by us within two years of the date of a member’s death.

PART 2: Application for a Death Benefit Application for Survivors’ Benefits Under the Québec Pension Plan Retraite Québec B-042A (201-01) Be sure you have answered all the questions in PART 1 before continuing with your application.

The Canada Pension Plan (CPP) offers the following benefits to eligible family members of deceased CPP contributors who have made sufficient contributions to the Plan: Death benefit

Binding nominations . Make a binding death benefit nomination for your TWUSUPER or Super Pension account. You can make a non-binding nomination online through Member Online or by calling us on 1800 222 071 between 8am and 8pm (AEST/AEDT) weekdays.

Service Canada. Personal Information Bank HRSDC PPU 146. Application for a Canada Pension Plan Death Benefit. It is very important that you: – send in this form with supporting documents (see the information sheet for the documents we need); and – use a . pen. and . print . as clearly as possible. SECTION A – INFORMATION ABOUT THE DECEASED. 1A. Social Insurance Number. 1B. Date of …

Employment Insurance Compassionate Care benefits are available to eligible workers to provide care or support to a family member who is gravely ill with a significant risk of death within 26 weeks (patient).

A naming takes effect the date this form is completed; however, this form must be received by the Government of Canada Pension Centre prior to your death. Therefore, it is recommended that the completed form be forwarded by express mail to the address indicated below.

Protected “B” when completed. Supplementary Death Benefit Plan – Beneficiary Information. Provision of the information requested on this form may be used for the purpose of establishing entitlement to benefits under the Public Service Superannuation Act (PSSA).

Application for Survivors’ Benefits Retraite Québec

Retiring from the Public Service of Canada some useful tips

The EI sickness benefits program is based on the premise that an individual is sick and unable to work, which does not take into consideration the context for an individual living with an episodic disability.

Service Canada. Disponible en français . How to Apply for the Canada Pension Plan (CPP) Death Benefit. Information Sheet. Getting started. Please read this information sheet before you

Other claim forms Accidental Death Benefit If an accidental death benefit is included in the deceased member’s Core Plan, please complete and return the form below.

Nplan death benefit – service canada Open document Search by title Preview with Google Docs Protected b (when completed) sc isp-1200 (2016-05-09) e 1 of 4.

I understand that Service Canada will not communicate my disability benefit information: – if my consent is received more than one year from the day I signed it, – if I cancel my authorization to allow Service Canada and my insurer to communicate my disability benefit

Include the following information with the Proof of Death form. Beneficiary Statement(s). (See attached. If there is more than one beneficiary, please make a copy of the front and back of the statement.) Photocopy of the death certificate. Copies of all enrollment forms and change of beneficiary cards. For AD&D and Seat Belt claims, attach photocopies of newspaper clippings, police or accident

Request for Estimate Canada Pension Plan Death Benefit

Defined Benefit Forms

Employment Insurance Compassionate Care benefits are available to eligible workers to provide care or support to a family member who is gravely ill with a significant risk of death within 26 weeks (patient).

concerning the Canada Pension Plan Death benefit. The information reflects the Canada Pension Plan legislation. If there are any differences between what is in the Information Sheet and the Canada Pension Plan legislation, the legislation is always right. Please read this information sheet before you complete your application. The explanations match the box numbers on the application form

Death benefit is a one-time payment to, or on behalf of, the estate of a deceased Canada Pension Plan contributor. Survivor Benefits Survivor benefits are paid to a deceased contributor’s estate, surviving spouse or common-law partner and dependent

numbers on the application form. common-lawpartner at the time of his/her death; and • your deceased spouse or common-lawpartner must have made enough contributions to the Canada Pension Plan; and • you must apply in writing and submit the necessary documents. If you were legally separated from your deceased spouse at the time of his/her death, you may still qualify for a Survivor’s

This guide provides information on Rollover benefits statement and Death benefit rollover statement forms and instructions. These forms are to be used by trustees of superannuation funds or retirement savings account (RSA) providers when rolling over benefits to …

I understand that Service Canada will not communicate my disability benefit information: – if my consent is received more than one year from the day I signed it, – if I cancel my authorization to allow Service Canada and my insurer to communicate my disability benefit

GROUP LIFE ASSURANCE Canada Life Financial

Applying for Death Benefits Under FERS (PDF file) opm.gov

This form is completed by Funeral Home Operators. It is sent to the federal government to determine if the deceased is eligible for the Canada Pension Plan Death Benefit. It is sent to the federal government to determine if the deceased is eligible for the Canada Pension Plan Death Benefit.

PROTECTED B (when completed) SC ISP-1200 (2015-04-15) E 1 of 4. Service Canada. Personal Information Bank ESDC PPU 146. Application for a Canada Pension Plan

numbers on the application form. common-lawpartner at the time of his/her death; and • your deceased spouse or common-lawpartner must have made enough contributions to the Canada Pension Plan; and • you must apply in writing and submit the necessary documents. If you were legally separated from your deceased spouse at the time of his/her death, you may still qualify for a Survivor’s

I understand that Service Canada will not communicate my disability benefit information: – if my consent is received more than one year from the day I signed it, – if I cancel my authorization to allow Service Canada and my insurer to communicate my disability benefit

In the event of death within one year of marriage, no survivor benefit is payable unless the President of the Treasury Board is provided with satisfactory proof that the contributor’s health at the time of the marriage was such that he/she was expected to live for at least one year.

Death in Service and Life Insurance. Many employers will offer what is known as death in service benefit as part of a general employment benefit package, paying out if you die while you are working for the company in question.

GROUP LIFE ASSURANCE eProduct Policy Conditions for death in service benefits under registered schemes eProduct Policy Conditions These Policy Conditions are …

EI Sickness Benefits MS Society of Canada

Rollover benefits statement and instructions for

Application for payment of a spouse or de facto partner benefit upon the death of a SASS pensioner (Member Form 407) [199.6 KB] Continuity of scheme membership (Member Form 238) [196.3 KB] Application for early release of a benefit on grounds of severe financial hardship (Member Form …

Canada Revenue Agency What to do following a death Service Canada should also be advised of the deceased’s date of death. For more information, or to get the address of the Service Canada Centre nearest you, call 1-800-622-6232. Was the deceased paying tax by instalments? If the deceased person was paying tax by instalments, no further instalment payments have to be made after his or her

The Canada Pension Plan (CPP) offers the following benefits to eligible family members of deceased CPP contributors who have made sufficient contributions to the Plan: Death benefit

Bereavement Benefits and W idow’s Benefit . 1 Changes you must tell us about Y ou can phone The Pension Service on 0191 21 87777 ( 44 191 21 87777 if phoning from outside the UK) or write to us about s omething that has changed.The address is: The Pension Service T yneview Park Newcastle upon Tyne England NE98 1BA Please tell us your full name and address and United Kingdom (UK) …

Application for CPP Death Benefit Service Canada Forms

Information Sheet HowtoApplyfortheCanadaPensionPlan(CPP

Inform and provide a death certificate to the deceased person’s bank, government agency, credit card company, utility companies, postal service and any other provider that needs to stop or change their service.

Application Process: The executor should apply for the benefit within 60 days of the date of death * Complete the application and mail it to the closest Service Canada Centre Documents Required: Death Certificate * Indicate the deceased’s Social Insurance Number on all documents before sending

Description; Description (Service) One-time, lump-sum payment to the estate on behalf of a deceased Canada Pension Plan contributor * amount of death benefit is either six times the worker’s monthly retirement pension, or 00, whichever is less

PROTECTED B (when completed) SC ISP-1200 (2016-05-09) E of 4. Service Canada. Personal Information Bank ESDC PPU 146. Application for a Canada Pension Plan

A completed Physician Statement is required if death occurs within two years of coverage being approved or, if the benefit is more than 0,000 and coverage has been in effect for less than five years. This is in addition to an official death certificate.

The Canada Pension Plan (CPP) offers the following benefits to eligible family members of deceased CPP contributors who have made sufficient contributions to the Plan: Death benefit

Include the following information with the Proof of Death form. Beneficiary Statement(s). (See attached. If there is more than one beneficiary, please make a copy of the front and back of the statement.) Photocopy of the death certificate. Copies of all enrollment forms and change of beneficiary cards. For AD&D and Seat Belt claims, attach photocopies of newspaper clippings, police or accident

Employment Insurance Compassionate Care benefits are available to eligible workers to provide care or support to a family member who is gravely ill with a significant risk of death within 26 weeks (patient).

Retiring from the Public Service of Canada Some Useful Tips Protecting our members Programs Section I Membership Programs Branch I 2008

This guide provides information on Rollover benefits statement and Death benefit rollover statement forms and instructions. These forms are to be used by trustees of superannuation funds or retirement savings account (RSA) providers when rolling over benefits to …

The Canada Pension Plan (CPP) death benefit is a one-time, lump-sum payment to the estate on behalf of a deceased CPP contributor. If an estate exists, the executor named in the will or the administrator named by the Court to administer the estate applies for the death benefit.

This form is completed by Funeral Home Operators. It is sent to the federal government to determine if the deceased is eligible for the Canada Pension Plan Death Benefit. It is sent to the federal government to determine if the deceased is eligible for the Canada Pension Plan Death Benefit.

The Canada Pension Plan offers a death benefit to be paid out to an eligible applicant. Here’s what you should know about the CPP death benefit.

idow’s Benefit Bereavement Benefits and

CPP Death & Survivor’s Benefit ecofuneral.ca

To qualify for the Death benefit: To apply for the benefit: • You must complete an application form (available from Service Canada) and mail in. • There is no time limit to apply. What to expect once the benefit is approved: • You can receive up to a one time maximum amount of ,500. servicecanada.gc.ca Survivor Benefits: Survivor’s Pension To qualify for Survivor’s Pension

Service Center: P.O. Box 305800, Nashville, TN 37230-5800 USE THIS FORM ONLY WITH CLAIMS FOR NATURAL DEATH BENEFITS OF ,000.00 OR LESS ON INCONTESTABLE POLICIES

A completed Physician Statement is required if death occurs within two years of coverage being approved or, if the benefit is more than 0,000 and coverage has been in effect for less than five years. This is in addition to an official death certificate.

The death benefit is a lump-sum benefit that is intended to help defray some of the costs resulting from death. The amount of the benefit is equal to six times the amount of the “calculated retirement pension” of the deceased contributor, to a maximum of ,500.

The Canada Pension Plan (CPP) offers the following benefits to eligible family members of deceased CPP contributors who have made sufficient contributions to the Plan: Death benefit

Retiring from the Public Service of Canada Some Useful Tips Protecting our members Programs Section I Membership Programs Branch I 2008

Canada Revenue Agency What to do following a death the deceased was receiving Canada Child Tax Benefit (CCTB) payments and/or Universal Child Care Benefit (UCCB) payments for a child; or the deceased was a child for whom CCTB and/or UCCB and/or GST/HST credit payments are paid. Service Canada should also be advised of the deceased’s date of death. For more information, or to get the

The EI sickness benefits program is based on the premise that an individual is sick and unable to work, which does not take into consideration the context for an individual living with an episodic disability.

A death benefit is a payout to the beneficiary of a life insurance policy, annuity or pension when the insured or annuitant dies. A death benefit may be a percentage of the annuitant’s pension.

Service Canada. Personal Information Bank HRSDC PPU 146. Application for a Canada Pension Plan Death Benefit. It is very important that you: – send in this form with supporting documents (see the information sheet for the documents we need); and – use a . pen. and . print . as clearly as possible. SECTION A – INFORMATION ABOUT THE DECEASED. 1A. Social Insurance Number. 1B. Date of …

Information Sheet HowtoApplyfortheCanadaPensionPlan(CPP

What Is the CPP Death Benefit and Who Should Apply?

Most employers in Canada have established private employee benefit plans to supplement the government-sponsored hospital and medical plans. These plans include coverage for medically-

Service Canada. Disponible en français . How to Apply for the Canada Pension Plan (CPP) Death Benefit. Information Sheet. Getting started. Please read this information sheet before you

numbers on the application form. common-lawpartner at the time of his/her death; and • your deceased spouse or common-lawpartner must have made enough contributions to the Canada Pension Plan; and • you must apply in writing and submit the necessary documents. If you were legally separated from your deceased spouse at the time of his/her death, you may still qualify for a Survivor’s

Application Process: The executor should apply for the benefit within 60 days of the date of death * Complete the application and mail it to the closest Service Canada Centre Documents Required: Death Certificate * Indicate the deceased’s Social Insurance Number on all documents before sending

The benefits under the Canada Pension Plan are: disability pension, retirement pension, death benefit, survivor’s pension, disabled contributor’s child’s benefit, orphan’s benefit, and post- retirement benefit.

Service Canada. Personal Information Bank HRSDC PPU 146. Application for a Canada Pension Plan Death Benefit. It is very important that you: – send in this form with supporting documents (see the information sheet for the documents we need); and – use a . pen. and . print . as clearly as possible. SECTION A – INFORMATION ABOUT THE DECEASED. 1A. Social Insurance Number. 1B. Date of …

The death benefit is a lump-sum benefit that is intended to help defray some of the costs resulting from death. The amount of the benefit is equal to six times the amount of the “calculated retirement pension” of the deceased contributor, to a maximum of ,500.

This guide provides information on Rollover benefits statement and Death benefit rollover statement forms and instructions. These forms are to be used by trustees of superannuation funds or retirement savings account (RSA) providers when rolling over benefits to …

This form is completed by Funeral Home Operators. It is sent to the federal government to determine if the deceased is eligible for the Canada Pension Plan Death Benefit. It is sent to the federal government to determine if the deceased is eligible for the Canada Pension Plan Death Benefit.

CPP Death Benefit The Canada Pension Plan (CPP) death benefit is a one-time, lump-sum payment to the estate on behalf of a deceased CPP contributor, wherever qualified. If an estate exists , the executor named in the will or the administrator named by the Court to administer the estate applies for the death benefit.

The Canada Pension Plan offers a death benefit to be paid out to an eligible applicant. Here’s what you should know about the CPP death benefit.

PWGSC-TPSGC 2196 Naming or Substitution of a Beneficiary

EI Sickness Benefits MS Society of Canada

PROTECTED B (when completed) SC ISP-1200 (2016-05-09) E of 4. Service Canada. Personal Information Bank ESDC PPU 146. Application for a Canada Pension Plan

CPP Death Benefit The Canada Pension Plan (CPP) death benefit is a one-time, lump-sum payment to the estate on behalf of a deceased CPP contributor, wherever qualified. If an estate exists , the executor named in the will or the administrator named by the Court to administer the estate applies for the death benefit.

Bereavement Benefits and W idow’s Benefit . 1 Changes you must tell us about Y ou can phone The Pension Service on 0191 21 87777 ( 44 191 21 87777 if phoning from outside the UK) or write to us about s omething that has changed.The address is: The Pension Service T yneview Park Newcastle upon Tyne England NE98 1BA Please tell us your full name and address and United Kingdom (UK) …

Service Canada. Information Sheet How to Apply for the Canada Pension Plan (CPP) Death Benefit Getting started Please read this information sheet before you complete your application. The explanations match the box numbers on the application form. Please use a pen to complete your application and be sure to print as clearly as possible. Fill out as much of the application form as …

Death in Service and Life Insurance. Many employers will offer what is known as death in service benefit as part of a general employment benefit package, paying out if you die while you are working for the company in question.

Public Service Management Insurance Plan Claim for Death Benefit Industrial Alliance Insurance and Financial Services Inc. Form 5948 (05 05) Group Policy No. G68-1400 A CLAIM CONSISTS OF FORM 5948 (PARTS 1 AND 2) AND FORM 5949 (PARTS 1, 2 AND 3). Instructions to Claimant (Form 5948 – attached) Please complete and sign Part 1 of the attached form. If the claim is for an accidental death…

Medical Certificate for Employment Insurance Compassionate

Application for Survivors’ Benefits Retraite Québec

PROTECTED B (when completed) SC ISP-1200 (2015-04-15) E 1 of 4. Service Canada. Personal Information Bank ESDC PPU 146. Application for a Canada Pension Plan

Retiring from the Public Service of Canada Some Useful Tips Protecting our members Programs Section I Membership Programs Branch I 2008

The benefits under the Canada Pension Plan are: disability pension, retirement pension, death benefit, survivor’s pension, disabled contributor’s child’s benefit, orphan’s benefit, and post- retirement benefit.

This guide provides information on Rollover benefits statement and Death benefit rollover statement forms and instructions. These forms are to be used by trustees of superannuation funds or retirement savings account (RSA) providers when rolling over benefits to …

Canada Revenue Agency What to do following a death the deceased was receiving Canada Child Tax Benefit (CCTB) payments and/or Universal Child Care Benefit (UCCB) payments for a child; or the deceased was a child for whom CCTB and/or UCCB and/or GST/HST credit payments are paid. Service Canada should also be advised of the deceased’s date of death. For more information, or to get the

Federal service (both civilian and military) and the relationship of the applicant to the deceased determine the type of benefit payable. Definitions: Employee Anyone who was still on the agency’s employment rolls at the time of death, even if he or she had applied for disability retirement and his/her pay had already stopped. Former Employee Anyone who was no longer on an agency’s

The EI sickness benefits program is based on the premise that an individual is sick and unable to work, which does not take into consideration the context for an individual living with an episodic disability.

The Canada Pension Plan offers a death benefit to be paid out to an eligible applicant. Here’s what you should know about the CPP death benefit.

Canada Pension Plan Survivors Benefit Every effort is made to ensure that the information in this database is accurate, up-to-date and comprehensive. However, Information Barrie cannot assume liability resulting from errors or omissions.

To qualify for the Death benefit: To apply for the benefit: • You must complete an application form (available from Service Canada) and mail in. • There is no time limit to apply. What to expect once the benefit is approved: • You can receive up to a one time maximum amount of ,500. servicecanada.gc.ca Survivor Benefits: Survivor’s Pension To qualify for Survivor’s Pension

Life Insurance FAQ’s Life Insurance Under the Supplementary Death Benefit Plan As a member of the Public Service Pension Plan ( Public Service Superannuation Act ), you have life insurance coverage under the Supplementary Death Benefit Plan.

Service Center: P.O. Box 305800, Nashville, TN 37230-5800 USE THIS FORM ONLY WITH CLAIMS FOR NATURAL DEATH BENEFITS OF ,000.00 OR LESS ON INCONTESTABLE POLICIES

Application Process: The executor should apply for the benefit within 60 days of the date of death * Complete the application and mail it to the closest Service Canada Centre Documents Required: Death Certificate * Indicate the deceased’s Social Insurance Number on all documents before sending

Claim for Funeral Benefit A Funeral Benefit is a one-off payment made by the Department of Veterans’ Affairs (DVA) to assist toward the funeral costs of veterans and, in some cases, their dependants.

What Is the CPP Death Benefit and Who Should Apply?

Am I Eligible for a Social Security Death Benefit?

We will not pay any benefit, or any additional amounts of benefit, if a completed claim form, in respect of the benefit being claimed, has not been received by us within two years of the date of a member’s death.

D0506A – Qualifying Service Details – Supplementary form to D0506 for service by a member of the ADF during the Second World War D0507 – Qualifying Service Claim – Commonwealth or Allied Veteran D0507A – Qualifying Service Details – Supplementary form to D0507 for service with the Armed Forces of the Republic of Vietnam

This guide provides information on Rollover benefits statement and Death benefit rollover statement forms and instructions. These forms are to be used by trustees of superannuation funds or retirement savings account (RSA) providers when rolling over benefits to …

Canada Revenue Agency What to do following a death Service Canada should also be advised of the deceased’s date of death. For more information, or to get the address of the Service Canada Centre nearest you, call 1-800-622-6232. Was the deceased paying tax by instalments? If the deceased person was paying tax by instalments, no further instalment payments have to be made after his or her

Service Canada. Information Sheet How to Apply for the Canada Pension Plan (CPP) Death Benefit Getting started Please read this information sheet before you complete your application. The explanations match the box numbers on the application form. Please use a pen to complete your application and be sure to print as clearly as possible. Fill out as much of the application form as …

It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact the authoring department to request a format other than those available.

Public Service Management Insurance Plan Claim for Death Benefit Industrial Alliance Insurance and Financial Services Inc. Form 5948 (05 05) Group Policy No. G68-1400 A CLAIM CONSISTS OF FORM 5948 (PARTS 1 AND 2) AND FORM 5949 (PARTS 1, 2 AND 3). Instructions to Claimant (Form 5948 – attached) Please complete and sign Part 1 of the attached form. If the claim is for an accidental death…

A death benefit is a payout to the beneficiary of a life insurance policy, annuity or pension when the insured or annuitant dies. A death benefit may be a percentage of the annuitant’s pension.

The death benefit is a lump-sum benefit that is intended to help defray some of the costs resulting from death. The amount of the benefit is equal to six times the amount of the “calculated retirement pension” of the deceased contributor, to a maximum of ,500.

Death in Service and Life Insurance. Many employers will offer what is known as death in service benefit as part of a general employment benefit package, paying out if you die while you are working for the company in question.

Retiring from the Public Service of Canada some useful tips

Accrued Benefits by a Surviving Spouse or Child (Including Death Compensation if Applicable) or VA FORM 21-535, Application for Dependency and Indemnity Compensation by Parent(s) (Including Accrued Benefits and Death Compensation When Applicable).

Retiring from the Public Service of Canada some useful tips

Request for Estimate Canada Pension Plan Death Benefit

The Canada Pension Plan (CPP) offers the following benefits to eligible family members of deceased CPP contributors who have made sufficient contributions to the Plan: Death benefit

Proof of Death Individuals & Families

Medical Certificate for Employment Insurance Compassionate

Death benefit is a one-time payment to, or on behalf of, the estate of a deceased Canada Pension Plan contributor. Survivor Benefits Survivor benefits are paid to a deceased contributor’s estate, surviving spouse or common-law partner and dependent

Canada Revenue Agency What to do following a death

The death benefit is a lump-sum benefit that is intended to help defray some of the costs resulting from death. The amount of the benefit is equal to six times the amount of the “calculated retirement pension” of the deceased contributor, to a maximum of ,500.

Public Service Management Insurance Plan Claim for Death

Application for CPP Death Benefit Service Canada Forms

SC ISP-1200A (2016-05-09) E / Service Canada. Information Sheet How to Apply for the Canada Pension Plan (CPP) Death Benefit Getting started Please read this information sheet before you

Proof of Death Individuals & Families

Application for Survivors’ Benefits Retraite Québec

Death Benefit Canada.ca